In January, India raised the gold import duty 90% and doubled the tax on silver as the government is struggling with a growing fiscal deficit and looked to increase revenues. Growing subsidies for fuel and food have left the government struggling to meet its budget target.

Indian investors, who are the largest consumer group of gold in the world, rushed to buy gold in advance of the government’s plan to increase the 4% customs tax in April 2012.

From Goldcore:

Gold’s London AM fix this morning was USD 1,649.00, EUR 1,263.02, and GBP 1,049.05 per ounce.

Yesterday's AM fix was USD 1,646.75, EUR 1,262.26and GBP 1,052.57 per ounce.

Gold closed in New York yesterday at $1,657.30/oz. Gold tumbled in Asia and its low hit $1,645.86/oz and high $1,664.71/oz and is now trading in Europe at $1,646.73/oz.

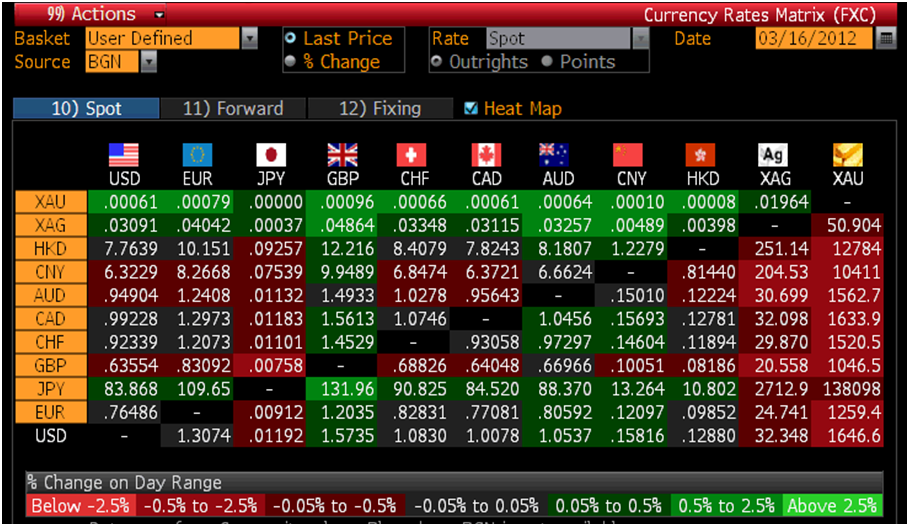

Cross Currency Table – (Bloomberg)

Gold traded lower on Friday, moving towards a third straight week of losses on the backdrop of a recovering US economy, which prompted investors to put their money in other vehicles, while India’s plan to double the import duty on gold bullion erased some early gains.

On news that Finance Minister Pranab Mukherjee proposed to double the 4% customs duty on gold from April 2012, physical dealers saw some panic buying from India, the world’s largest gold consumer.

In January, India raised the gold import duty 90% and doubled the tax on silver as the government is struggling with a growing fiscal deficit and looked to increase revenues. Growing subsidies for fuel and food have left the government struggling to meet its budget target.

Indian investors, who are the largest consumer group of gold in the world, rushed to buy gold in advance of the government’s plan to increase the 4% customs tax in April 2012. The resulting gains where then eroded by stronger then expected US economic growth numbers.

Market participants will watch US consumer prices data which come out at 12.30 GMT.

Bloomberg Survey

Bloomberg’s survey of 26 bullion analysts show 13 expect prices to rise next week and 4 were neutral, the lowest ratio since Jan. 20th. Hedge funds lowered their bets on a rally by the most since August 2008 in the week ended March 6th, Commodity Futures Trading Commission data show. Bullion prices dropped to an 8 week low on March 14th, fifteen percent below September’s record, and have now dipped beneath the 200- day moving average, a sign of more declines to some market participants.

Gold traders are the least bullish in 2 months after prices erased more than half of this year’s gain on thoughts that a recovering US economy will reduce the likelihood of further Quantitative Easing from the Fed which would include more bond purchases. Gold’s pulled back as the dollar gained after Fed policy makers raised their assessment of the US economy on March 13th.

Central Banks

A decline in prices will allow central banks to increase their reserves. The World Gold Council data shows central banks added 439.7 tons last year, the most in almost 50 years, and project they will buy a similar amount in 2012.

Futures Contracts & ETFs

Open interest in US futures dropped to 437,593 on March 14th, from 523,284 on Sept. 6th, when prices hit a record $1,923.70/oz. Hedge funds and other institutions had a net-long position of 145,997 futures and options by March 6, the lowest level since the end of January, CFTC data showed.

That contrasts with investors in gold-backed ETF products, whose combined holdings grew to a record 2,410.2 metric tons on March 13the now valued at $128.1 billion, as Bloomberg’s data shows. A Bloomberg survey by 14 analysts from the Precious Metals Conference in NY, predict gold bullion to continue its rise for a 12th consecutive year and reach a target of $1,897/oz by Dec. 31st.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $32.25/oz, €24.62/oz and £20.48/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,665.50/oz, palladium at $691./oz and rhodium at $1,425/oz.

NEWS

(Wall Street Journal)

India to Double Gold Import Duty

(Reuters)

Gold gives up early gains on India's import duty hike plan

(Bloomberg)

Gold Bulls Weakest in Two Months as Economy Gains: Commodities

COMMENTARY

(MarketWatch)

Gold edges higher in Asian trading

(Max Keiser)

Max talks to Goldcore’s Mark O’Byrne about Germany’s gold, Ireland’s austerity and a trial for Bertie Ahern