From Goldcore:

Gold’s London AM fix this morning was USD 1,721.00, EUR 1,303.10, and GBP 1,091.80 per ounce.

Yesterday's AM fix was USD 1,727.00, EUR 1,302.22, and GBP 1,093.17 per ounce.

Cross Currency Table – (Bloomberg)

Gold fell overnight in Asia despite the Moody’s European downgrades and very gold friendly news regarding the very poor Japanese and US fiscal positions. Moody’s Investors Service cut the debt ratings of six European countries including Italy, Spain and Portugal and said it may strip France and the U.K. of their top Aaa ratings

Gold rose in Japanese yen again this morning after the Japanese announced that they are further expanding their “asset-purchase program” while keeping interest rates at zero and increasing the size of its “powerful monetary easing” to ¥65 trillion ($835.83 billion) from ¥55 trillion, with the net ¥10 trillion increase earmarked for the purchase of Japanese government bonds.

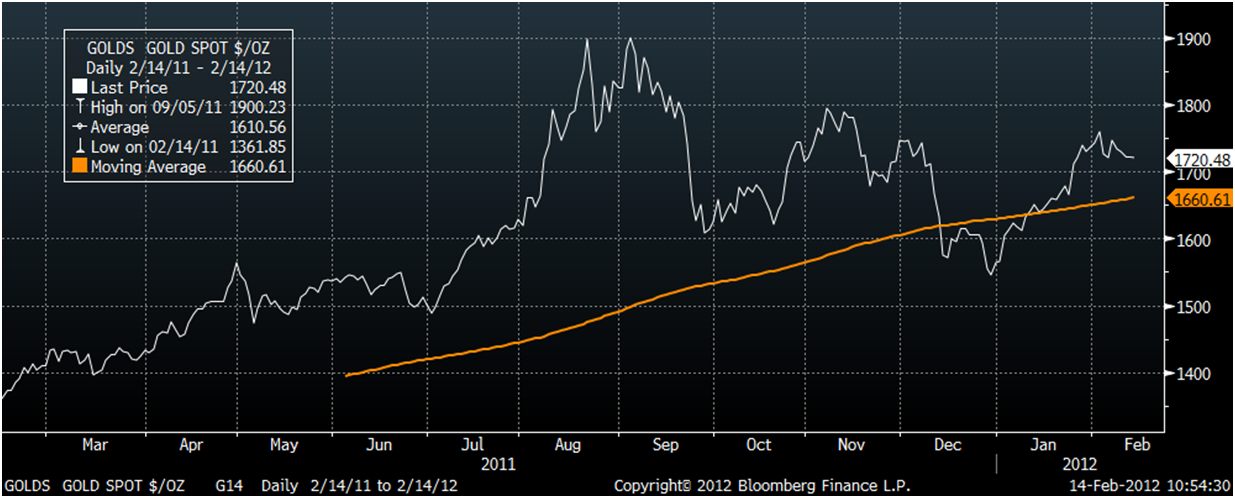

Gold Spot $/oz (Bloomberg)

Safe haven demand for gold continues due to concerns that Greece’s “bail out” is yet another short term panacea and Moody's downgrade of various European nations' ratings have reignited contagion fears.

Greece is but a small pebble in the pond when compared to the huge levels of debt seen in Japan, the UK, the US. The Moody’s downgrade may cause ripples in markets which could lead to waves which could coalesce a tsunami of financial contagion across Europe and much of the world.

While all the focus has been on Greece in recent days, the global nature of the debt crisis came to the fore yesterday and overnight. This was seen in the further desperate measures by the BOJ and Moodys warning that the UK could lose its AAA rating. Some of us have been saying for some years that this was inevitable but markets remain myopic of the risks posed by this.

Possibly the greatest risk is that of the appalling US fiscal situation which continues to be downplayed and not analysed appropriately. President Obama unveiled a massive $3.8 trillion budget yesterday and he is to increase Federal spending by 53% to $5.820 trillion by 2022.

U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt as of 14 Feb 2012 at 11:00:00 AM GMT is:

The estimated population of the United States is 312,222,693 so each citizen's share of this debt is $49,221.89.

The National Debt has continued to increase an average of $3.98 billion per day since September 28, 2007.

The US government is projected to spend over $6 trillion a year by 2022. Still bizarrely unaccounted for is the ticking time bomb of unfunded entitlement liabilities - Social Security and Medicare, which Washington continues to deal with by completely ignoring them.

While Washington and markets are for now ignoring the fiscal train wreck that is the US. This will change with inevitable and likely extremely negative consequences for markets – particularly US bond markets and for the dollar.

The coming US sovereign debt crisis in conjunction with the massive fiscal challenges facing the UK, Japan and Euro Zone countries makes gold an essential diversification today.

Indeed, not owning gold and those who advise against owning gold are irresponsible and imprudent in the extreme.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

OTHER NEWS

(Reuters Global Gold Forum) -- The world's first yuan-denominated gold ETF has got off to a lukewarm start on the HK stock exchange today, but the expectation in the analyst community is that demand will pick up as investors become more familiar with this sort of product.

(Bloomberg) -- Gold Held in Exchange-Traded Products 0.1% From All-Time High

Gold holdings in exchange-traded products backed by bullion stood at 2,390.065 metric tons yesterday, data compiled by Bloomberg show. This is about 0.1 percent, or 2.9 tons, from a December 13 record of 2,392.976 tons.

(Bloomberg) -- Touradji Sold Entire Stake in SPDR Gold Trust in Fourth Quarter

Touradji Capital Management LP, founded by Paul Touradji, sold its entire stake of 45,000 shares in the SPDR Gold Trust as of Dec. 31, a U.S. Securities and Exchange Commission filing showed today.

The SPDR trust is the biggest exchange-traded product backed by physical gold.

(Bloomberg) -- GLG Partners Sells Stake in SPDR Gold Trust in Fourth Quarter

GLG Partners LP sold its stake in the SPDR Gold Trust, an exchange-traded product backed by the precious metal, during the fourth quarter, a filing with the U.S. Securities and Exchange Commission showed.

GLG held no shares as of Dec. 31, down from 94,675 at the end of the third quarter, according to a 13F filing today. SPDR is the biggest exchange-traded product backed by gold.

(Bloomberg) -- Ethiopia Buys More Gold, Fuelling Money Supply, AFDB Says

Ethiopia’s central bank bought more gold from artisanal miners in the 2010-11 fiscal year than it planned to purchase within five years, fuelling money supply growth, the African Development Bank said.

The National Bank of Ethiopia acquired 6,615 kilograms (212,677 ounces) during the period, compared with the 5,250 kilograms it planned to buy over the 2010-15 period, the Tunis- based lender said in an e-mailed statement today. In the first quarter of the current fiscal year, the bank bought $109.5 million of gold from miners, 52 percent more than planned, it said.

“This unprecedented purchase of gold by the central bank has an effect similar to quantitative easing, as the monetary authority is injecting more money into the economy while reallocating its portfolio and building up its gold reserves,” the bank said.

Inflation in Ethiopia surged to 40.6 percent in August, stoked by what the International Monetary Fund said was “excessive” growth in money supply. Monetary expansion accounted for 40 percent of the increase in Ethiopian inflation, the African Development Bank said.

The supply of gold to the central bank increased because of a 5 percent premium over the international market price, the bank said. Ethiopia shipped 11.7 metric tons of gold in the 12 months to July 7, the end of Ethiopia’s fiscal year, according to the country’s Mines Ministry.

Gold for immediate delivery fell 0.3 percent to $1,717.88 an ounce as of 11:12 a.m. in Nairobi, paring its advance during the past 12 months to 26 percent.

SILVER

Silver is trading at $33.49/oz, €25.39/oz and £21.27/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,631.25/oz, palladium at $683/oz and rhodium at $1,500/oz.

NEWS

(Reuters)

Gold slips with euro as Europe jitters remain

(Wall Street Journal)

Gold Falls In Asia; Stronger Dollar Weighs

(BusinessWeek)

Gold Declines as Moody’s Downgrades Lift Dollar, Touradji Sells

(Reuters)

World's first yuan-denominated gold ETF makes weak debut

(AP via Youtube) Obama Unveils $3.8 Trillion Budget

COMMENTARY

(Wall Street Journal)

Gold Has Humbled Smart Men Before

(Jim Sinclair Mineset)

The Lonely Road We Take Together

(BusinessInsider)

Guess How Much It Costs The Government To Produce A Nickel

(The Gold Report)

'Mother of all gold bull markets remains intact'

(KingWorldNews)

Turk - Gold Panic Buying & Pulling Banks Back from the Brink

(ZeroHedge)

Moody's Downgrades Italy, Spain, Portugal And Others; Puts UK, France On Outlook Negative - Full Statement