In comparison to silver's 400% gain in 100 trading days in 1980, silver has gained a measly 73% over the past 100 trading days. This means that in a true parabolic blow-off top that merely equals 1980 in intensity, silver will be rising at 5 times its current pace!

From Sam Kirtley of S K Options Trading:

This essay will attempt to address the question of whether or not silver prices are in a bubble, or possibly may be turning into a bubble and if so what trading strategies may be suited to the situation. This article will hopefully provide another string to the readers bow in attempting to identify bubbles and being able to protect one’s portfolio and even potentially profit from them. For the record we feel it is prudent to state our view upfront, we do not think silver is in a bubble at this point in time. However we think that it is likely that it will become a bubble in the future, but we cannot say when or at what price.

Asset price bubbles have occurred since the beginning of financial markets and will continue to do so as long as there remains a marketplace for assets to be traded. A key property of a bubble is that is it near impossible to identify with certainty before it pops, but once it does pop the bubble is apparently obvious to everyone. In our opinion, only those who risk capital and profit betting against a bubble can claim to have correctly identified one.

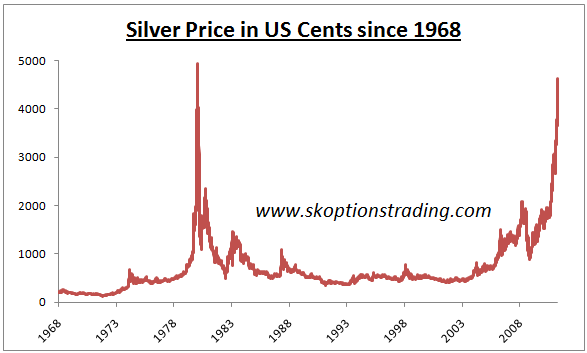

A casual glance at the chart could leave an impression that history is going to repeat itself and silver prices are about to crash. However in order to not only successfully indentify bubbles but also profit from them, one will need to know the tipping point. This is the point at which the bubble is unsustainable and begins to breakdown.

There are many factors which contribute to the emergence of bubbles and one would need to look at a myriad of factors to determine when a bubble may pop. We will focus on just one in this article, momentum. In finance, momentum is the empirically observed tendency for rising asset prices to continue to rise. We are attempting to gauge when silver may run out of momentum and when this bull market will turn into a bubble and ultimately pop.

Whilst some may consider it crude to study momentum as opposed to fundamentals such as supply and demand, we feel that it is vitally important from both a psychological and technical standpoint. Psychologically if investors are used to silver prices increasing 30% per year and then silver prices only increase at a rate of say 15% for one year, psychologically this return looks poor on a relative basis, even though it is still positive and normally would leave many investors satisfied. Therefore there is a greater incentive to sell silver since it is not performing as well as it was in the past. Technically once a bubble is fully underway prices begin to rise in a parabolic or exponential fashion. If the price ceases to rise in an exponential fashion, selling will commence, even if the price is still rising, since investors will have extrapolated the exponential rise and so anything short of parabolic will not meet their expectations.

The most recent example of this was in the housing bubble. Prices didn’t actually have to fall at all to trigger a crash, all they had to do was plateau or rise sluggishly and this would spark selling by people who had bet on prices continuing to rise. Without continually rising prices real estate investors could not refinance and borrow more against their properties to buy additional properties or other assets, so the buying stopped and the selling began. This was when the bubble popped; this was the tipping point before the actual crash that many investors strive to identify.

So how does this relate to silver? Although we believe that silver does indeed have strong fundamentals, we do think it is likely that the metal will become drastically overvalued in the future as a result of speculative buying by the masses. In an attempt to measure the momentum behind silver and when this momentum will run out, we have analyzed the rate of silver prices increases over the last 50 years or so, since 1968.

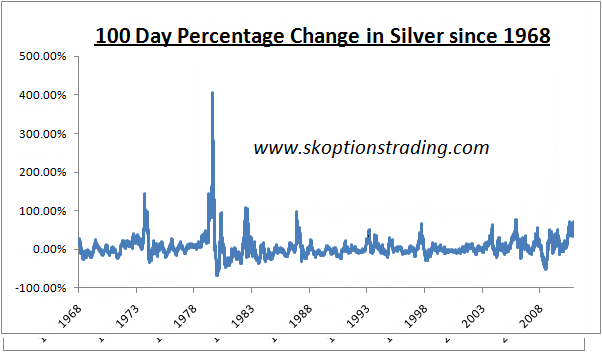

The chart below shows the rolling 100 day percentage change in the silver price. This is not a perfect measure of momentum, but it’s a start.

As you can see, during the blow off in 1980, silver prices were increasing at a rate of roughly 400% per 100 trading days. This compares with a current rate of increase of approximately 73% per 100 trading days. So if you think silver’s current rally is going at a nose bleed pace, in the 1980 blow of silver prices were increasing 5.47 times faster than they are at the moment.

So far it appears that the rate of increase in silver prices at present is still below the relative rate of increase in 1980, therefore implying there is further upside. However this analysis doesn’t take into account that the Bunker-Hunt brothers were attempting to corner the market for physical silver in the late 70s, a buying force which is not present today. Therefore one should err on the side of caution when using this barometer for trading purposes as it may not reach 1980 levels. But at present the barometer isn’t even close, so we do not think silver is in bubble at the moment.

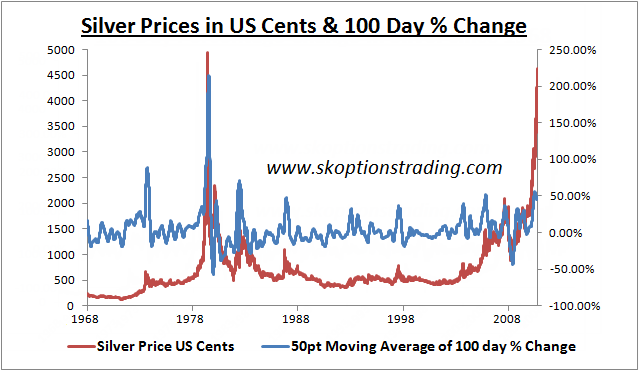

The chart below best shows how silver is far from in a bubble yet. We have smoothed the 100 day percentage change and overlaid the nominal silver price.

As shown by the blue line still being relatively low in contrast with 1980, there is still a great deal of upside potential for not only the silver price itself, but the rate at which silver prices are increasing. When both the blue and red lines are parabolic, then a bubble argument can be made.

As always the most important part of any discussion of the financial markets is how one should deploy capital. Whilst a silver bubble is not yet upon us, we are going to suggest some trading strategies that could offer attractive risk-reward dynamics should a bubble scenario unfold.

Many people would be inclined to take a short position if they believed silver was drastically overvalued and in a bubble. However in our opinion this is not a particularly attractive trade. Whilst of course the investor will make money if silver prices fall, the investor is also open to unlimited liability on the upside and should silver prices continue to rise substantial losses could be incurred. Taking an outright short position via futures or short selling silver stocks implies that one believes that one’s timing is spot on. In reality nobody can ever have perfect timing so it makes sense to allow for some error in your judgement when placing the trade.

This is important when placing any trade, but it is particularly crucial where bubbles are concerned since the market is moving in extreme ways. In the 1980 blow off silver was increasing at a rate of over 100% per 30 days, anyone who was short would have got wiped out, just for being 30 days too early.

However by utilizing options the trader can take a position that will benefit from an imploding silver bubble but offers much better risk-reward dynamics than being outright short. There are two basic trades that we think would be attractive under such a scenario.

The first is allocating small amounts of capital to near term ‘out of the money’ puts. By purchasing puts that are say three months or less from expiration and at least 25% out of the money the investor is effectively buying insurance against a crash in silver prices. If silver prices plummet then the value of the puts will explode, but if prices keep soaring the downside is strictly limited to the premium paid for the put. If this trade is placed prematurely, it can be placed again in another few months, and again and again so long as the trader holds the view that silver prices are going to crash. If the view is correct then the eventual payoff will more than cover the cost of being too early in buying the initial puts.

The second trade is a longer term trade that involves selling at the money call vertical spreads which are more than a year from expiration. This expresses the view that prices are not sustainable in the longer term and therefore by the time the call options expire they will likely be worthless due the fall in silver prices. Additionally, if prices were spiking higher it is likely that call options would be being bought heavily by speculators, thereby inflating their premiums. By selling these call spreads one would benefit from a fall in silver prices and a reduction in call buying/increase in call selling by speculators over a longer term time period, without taking on unlimited risk.

We do not think either of these trades are attractive at present, we are merely pointing out that they may be in the future if a bubble scenario does unfold. For now we think it is a case of not pulling on Superman’s cape so to speak and letting silver run. If silver’s rise is going to be even half as fast as that of 1980 then it could still rise twice as fast as it is at present before blowing off. Our premium options trading service, SK OptionTrader, just closed its 70th recommended trade, 68 of which have been profitable with an average return of 40.51% per trade. Our model portfolio is up 256.04% since inception, an annualized return of 115.61% so if you would like to subscribe for just $199 per 6 months or $349 a year then please visit www.skoptionstrading.com . Subscribers get regular market updates as well as trading signals and access to our model portfolio.