From ProfitTimes

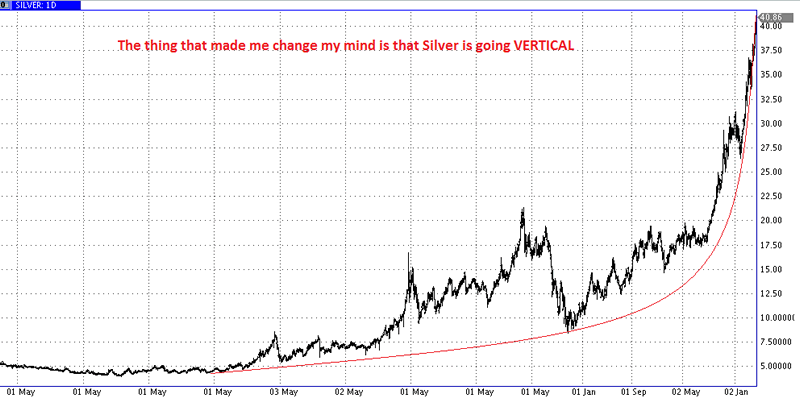

In this article, I will try to describe why we suddenly moved out of our positions in silver mining companies… First of all, like I posted two days ago, silver has been going Vertical, which should make us cautious:

While there is nothing wrong with being in something that is going straight up (it is even very exciting to see), we have to face the fact that nothing will go up until the end of times. It is like Isaac Newton’s Law of Gravity: “What goes up must come down”.

The thing is, when it eventually goes down, it does so in a very brutal way. It is possible that we see silver rise on Monday or Tuesday by 3-5%, followed by a Huge sell-off, closing at -5% or so. At the end of such a move, there is usually a lot of volatility.

So we better be prepared. Once again, as long as it doesn’t drop, there is nothing wrong, and one can realize a lot of gains…

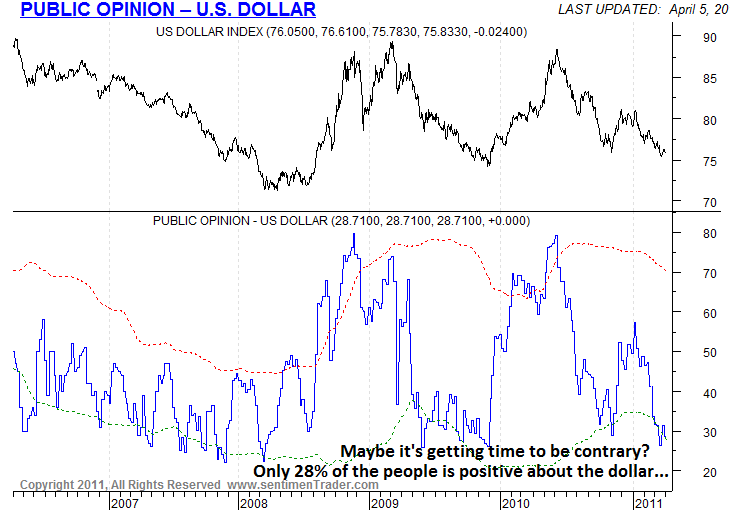

Second of all: the public opinion about the USD is very negative. Only 28% of the public is positive about the dollar. Why SHOULD one be positive about the dollar with so much debt and Quantitative Easing undermining the purchasing power of the greenback.

Well, as you know, sometimes I like to be a contrarian. My target for the EUR/USD is about 1.50, but it is well possible that the move would end around 1.45-1,48.

Chart courtesy sentimentrader.com

But anyway, as long as the dollar doesn’t bottom, the only protection is hard assets (stocks, art, real estate, and most importantly precious metals and commodities).

Then why did I suddenly move out of Silver positions?

As you probably know by now, I am very fascinated by the way things move and especially how history repeats in some way…

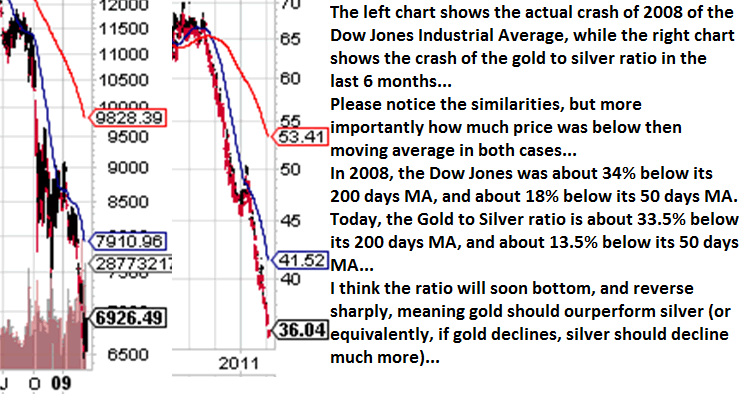

Below you see a chart of the stock market crash in 2008 on the left side, and a chart of the gold to silver ratio on the right side…

A falling gold-to-silver ratio implies silver rising faster than gold or falling more slowly. In this case, it was Silver rising MUCH faster than gold. A picture often says more than a thousand words:

Chart courtesy stockcharts.com

The gold-to-Silver ratio has been crashing in a way like the Dow Jones did in 2008: too much, too fast.

What followed for the Dow Jones index was a HUGE rally. Are we about to see the same in the Gold to Silver ratio?

This is another reason to be more cautious about Silver right now.

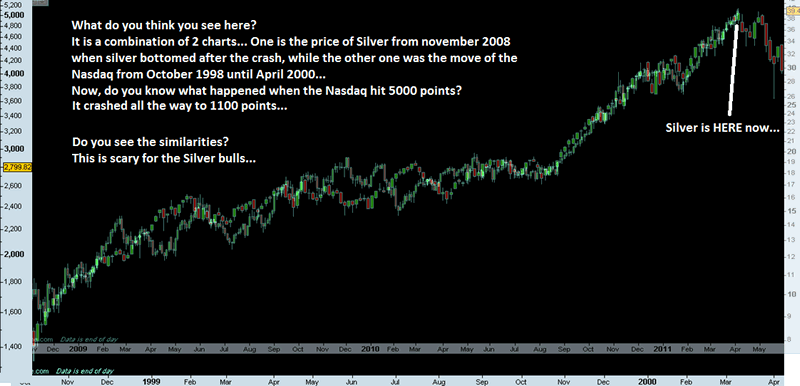

However, the one thing that completely changed my mind is the following chart:

Chart courtesy prorealtime.com