This is the aim of the International Enterprise Singapore, the city state’s external trade agency according to Bloomberg.

Currently just 2% of world gold demand flows through Singapore and Singapore is aiming to increase that to 10% to 15% over the next five to 10 years, Kathy Lai, assistant chief executive officer at IE Singapore, said.

Singapore will exempt investment grade gold, silver and platinum from the 7% goods and services tax to turn the country into a bullion trading hub, Finance Minister Tharman Shanmugaratnam told parliament in his budget speech on February 17.

From Goldcore:

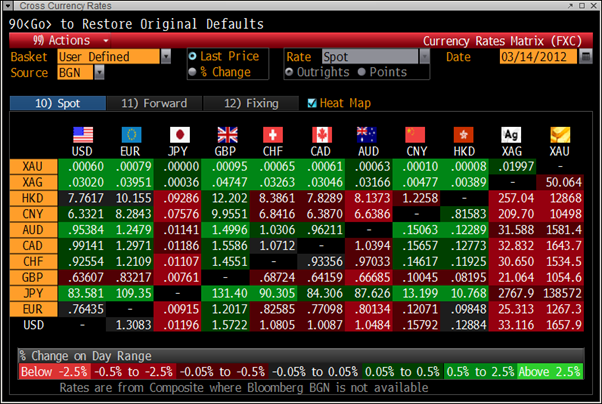

Gold’s London AM fix this morning was USD 1,662.00, EUR 1,271.61, and GBP 1,057.93 per ounce.

Yesterday's AM fix was USD 1,694.75, EUR 1,291.44and GBP 1,082.63 per ounce.

Gold fell 1.7% in New York yesterday and closed at $1,676.10/oz. Gold fell in Asia prior to further falls in Europe which has gold now trading at $1,656/oz.

Fed Chairman Ben Bernanke offered no insight as to whether there will be another round of QE and the Fed said the economy was "expanding moderately" though growth still faced significant downside risks.

Gold has broken below $1,660/oz to its lowest since January 25. Gold is now below the 200-day SMA at $1,681.08/oz as well as the 38.2% Fibonacci retracement from September's record to December's lows.

Support is at $1,650/oz and below that at $1,600/oz and $1,550/oz (see chart below).

Despite continuing caution regarding gold in western markets, lacklustre buying and indeed some selling - there is still strong buying from Asia store of wealth buyers.

Singapore Seeks To Be Asian Bullion Hub With Tax Free Gold and Silver

Another sign of Asia’s increasing importance in the global gold market is news that Singapore is planning to boost its share of global gold trade sevenfold after scrapping taxes on gold, silver and platinum bullion.

This is the aim of the International Enterprise Singapore, the city state’s external trade agency according to Bloomberg.

Currently just 2% of world gold demand flows through Singapore and Singapore is aiming to increase that to 10% to 15% over the next five to 10 years, Kathy Lai, assistant chief executive officer at IE Singapore, said.

Singapore will exempt investment grade gold, silver and platinum from the 7% goods and services tax to turn the country into a bullion trading hub, Finance Minister Tharman Shanmugaratnam told parliament in his budget speech on February 17. The change, which takes effect on Oct. 1, will apply to gold of 99.5 percent purity, silver of 99.9 percent purity and platinum of 99 percent purity.

“Most other financial centers consider gold as a financial asset so few place any kind of tax on precious metals and we discovered that it was an impediment,” said IE Singapore’s Lai. “We noted that gold demand increasingly is dominated by Asian consumers and investors and we feel that this is something we may have missed out on.”

Asia doesn’t have a so-called gold hub, where there’s a critical mass of traders and storage, like in London and Zurich, said Lai.

“Vis-a-vis Dubai, we are a more credible financial center, vis-a-vis Hong Kong, we are seen as not part of China and therefore more neutral,” she said.

This is another step towards price discovery in the precious metals market being related to supply and demand of the physical metal and not the machinations of banks and hedge funds manipulating the paper gold market on the COMEX.

Bloomberg Link Precious Metals Conference – Gold 21% Gain In 2012

The Bloomberg Link Precious Metals Conference took place in New York yesterday and the majority of participants were bullish on gold (see Other News below).

Gold may rise to $1,897/oz by December 31 from $1,566.80 at the end of 2011, based on the average of 14 respondents in a survey at the conference.

Gold is poised for a 21% gain in 2012, extending its bull market to 12 consecutive years, as investors diversify into gold and central banks expand reserves for the first time in a generation.

The majority of participants expect central banks will take additional steps to spur economic growth and continue to debase currencies.

OTHER NEWS

(Bloomberg) -- China Platinum Jewelry Use May Rise to 3 Million Ounces: BofA

China’s jewelry demand for platinum may rise to about 3 million ounces by 2016 from 1.8 million ounces in 2011, Michael Widmer, a London-based analyst at Bank of America Corp. said in a report e-mailed today.

(Bloomberg) -- India May Consider Tax Increases for Gold Imports, UBS Says

India may consider higher taxes for gold imports to reduce its fiscal deficit, UBS AG said. Outright controls on the quantity of imports may even be considered “although we give this riska remote possibility, not least because it might portend a re-opening of the old smuggling routes from yester years,” Edel Tully, an analyst at UBS, said in a report e-mailed today. India is set to publish its 2012 budget on March 16, she said.

(Bloomberg) -- Aggressive Investors Should Hold 20% in Gold, Tangent Says

More-aggressive investors should allocate 20 percent of their portfolio to gold, while conservative investors should put 10 percent into the precious metal, James Rickards, a senior managing director of Tangent Capital Partners, said today at the Bloomberg Link Precious Metals Conference in New York. China is doing everything possible to increase its ratio of gold holdings to gross domestic product, Rickards said.

(Bloomberg) -- Palladium May Surge to $1,000 An Ounce This Year, Lee Says

Palladium prices may jump to $1,000 an ounce this year as investor demand climbs, John Lee, the chairman of Prophecy Platinum Corp., said today at the Bloomberg Link Precious Metals Conference New York. Platinum may trade at a premium of 20 percent to 30 percent above gold prices, Lee said.

(Bloomberg) -- Platinum, Palladium Mining Getting Harder, Raithatha Says

It’s getting more difficult to mine platinum and palladium because costs are rising in South Africa and Russia, Rupen Raithatha, an analyst at Johnson Matthey, said today at the Bloomberg Link Precious Metals Conference New York.

(Bloomberg) -- Gold-Mining Deals Will Rise on Higher Prices, McEwen Says

Mergers and acquisitions among gold-mining companies will rise, Rob McEwen, the founder of Goldcorp Inc. and the current chairman and chief executive officer of McEwen Mining Inc., said today at the Bloomberg Link Precious Metals Conference in New York.

“At higher prices, a lot of people are investing in exploration and creating investing opportunities,” McEwen said. “Management should not sit on cash.”

(Bloomberg) -- Investors Should Hold Gold Even With Zero Returns, Artigas Says

It makes sense for investors to hold gold even when there are zero returns because the precious metal helps to preserve capital, especially during times of risk, Juan Carlos Artigas, a manager of investment research at the World Gold Council, said today at the Bloomberg Link Precious Metals Conference New York.

(Bloomberg) -- Gold May Rally to $2,150 at the End of This Year, Pento Says

Gold’s rally will extend to a record $2,150 an ounce at the end of 2012 as low interest rates boost demand for the precious metal, according to Michael Pento, president of Pento Portfolio Strategies in Holmdel, New Jersey.

Gold has climbed 8.4 percent this year and in September traded at a record $1,921.15 in London, as governments from the U.S. to the U.K. keep interest rates at all-time lows to shore up growth. The metal may end 2012 at $2,000 as the Federal Reserve takes more steps to boost growth, Francisco Blanch, head of global commodity research at Bank of America Merrill Lynch, told the Bloomberg Precious Metals conference in New York today.

“We have to own gold,” Pento, who correctly predicted the annual high for prices in the past three years, said during a panel at the conference.

Gold is heading for a 12th annual advance and investors now hold a record 2,408.98 metric tons valued at $131 billion, data compiled by Bloomberg show. Its gain this year to $1,694.85 an ounce today lags the 9.4 percent gain in the Standard & Poor’s GSCI gauge of 24 commodities and a 10 percent appreciation in the MSCI All-Country World Index of equities. Treasuries fell 0.5 percent, a Bank of America Corp. index shows.

Gold’s Fundamentals

“You have to trade it,” said Christoph Eibl, a founding partner of Zug, Switzerland-based Tiberius Asset Management AG. Gold probably has the worst fundamentals of all commodities and may end the year at $1,200 to $1,300, he said at the conference.

Gold is the “ultimate macro hedge,” Rachel Benepe, portfolio manager at First Eagle Gold Fund, First Eagle Investment Management LLC, said at the conference. “Gold is the ultimate downside protection,” she said. “When the system falls apart, gold goes up.” She declined to give a price forecast.

Steven Mathews, chief investment officer of Flintlock Capital Asset Management LLC in New York, forecast $1,880.

Shares of mining companies have lagged the price of gold, with the Philadelphia Gold & Silver Index of 16 members up 2.2 percent this year.

The purchase of a gold miner from outside the industry would be “very helpful” to the performance of the gold mining industry, Caesar Bryan, portfolio manager at the Gabelli Gold Fund, said at the conference. He predicted gold would end the year at $2,300 an ounce. “Should a company from outside the industry make an acquisition, that would be very interesting,” Bryan said.

(Bloomberg) -- U.S. Will Have QE3 by End of This Summer, Michael Pento Says

The U.S. will introduce a third round of quantitative easing by the end of the summer, Michael Pento, president, Pento Portfolio Strategies, said in an interview with Bloomberg Television.

“QE3 by the end of the summer is what I’m expecting, absolutely,” Pento said at the Bloomberg Precious Metals conference in New York. “There has been no healing in the economy. We have not deleveraged as an economy at all,” said Pento, adding that the commercial banks are financing $1 trillion of annual deficits.

(Bloomberg) -- Gold Prices ‘Fairly Pedestrian,’ Dundeewealth’s Murenbeeld Says

Gold prices are “fairly pedestrian” given the global low interest-rate environment, Martin Murenbeeld, chief economist at DundeeWealth Inc., said at the Bloomberg Precious Metals conference in New York.

Bullion is up 8 percent this year, heading for a 12th annual advance. Gold for immediate delivery reached a record $1,921.15 an ounce, and futures an all-time high of $1,923.70, in September.

(Bloomberg) -- Gold Is the ‘Ultimate Macro Hedge,’ First Eagle’s Benepe Says

Gold is the “ultimate macro hedge,” Rachel Benepe, portfolio manager at First Eagle Gold Fund, First Eagle Investment Management LLC, said today at the Bloomberg Precious Metals conference in New York.

“Gold is the ultimate downside protection,” Benepe said. “When the system falls apart, gold goes up.”

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWS

Reuters

Gold slips for third day; equities weigh, dollar weigh

Bloomberg

Gold Seen Heading for 12th Annual Advance on Investor Hoarding/ Buying

MarketWatch

Gold, silver sink in electronic trading

Wall Street Journal

Beijing Defends Stance on Minerals

COMMENTARY

Business Insider

JIM GRANT: Warren Buffett & Coca-Cola Investors Humiliated By Gold

CNBC

Video: Taleb on Next 'Black Swan' Event - Ron Paul?

Zero Hedge

Japan's Shocking Keynesian Slip: "We Are Worse Than Greece"

Zero Hedge

Presenting Bridgewater's Weimar Hyperinflationary Case Study

YouTube

Keiser Report: Cites Vulnerability of German, Swiss Gold Reserves