Gold has risen for the first time in three days. Asian stocks and the euro also gained today before German Chancellor Angela Merkel meets with the International Monetary Fund’s, Christine Lagarde in Berlin, a day after Merkel and French President Nicolas Sarkozy met to try minimize the Greek and Eurozone debt debacle.

Gold has risen for the first time in three days. Asian stocks and the euro also gained today before German Chancellor Angela Merkel meets with the International Monetary Fund’s, Christine Lagarde in Berlin, a day after Merkel and French President Nicolas Sarkozy met to try minimize the Greek and Eurozone debt debacle.Across the pond the USA's debt continues to rise above the 100% mark. That means the good and services of the US economy ($15.17 trillion) is equal to the entire debt of the country. Analysts project the economy would have to grow at least 6% a year to just stay afloat. Among advanced economies, only Greece, Iceland, Ireland, Italy, Japan and Portugal have debts larger than their economies. Greece, Ireland, Portugal and Italy are at the root of the European debt crisis. The first three needed bailouts from European central banks and Italy's finances are now monitored by the International Monetary Fund.

From Goldcore:

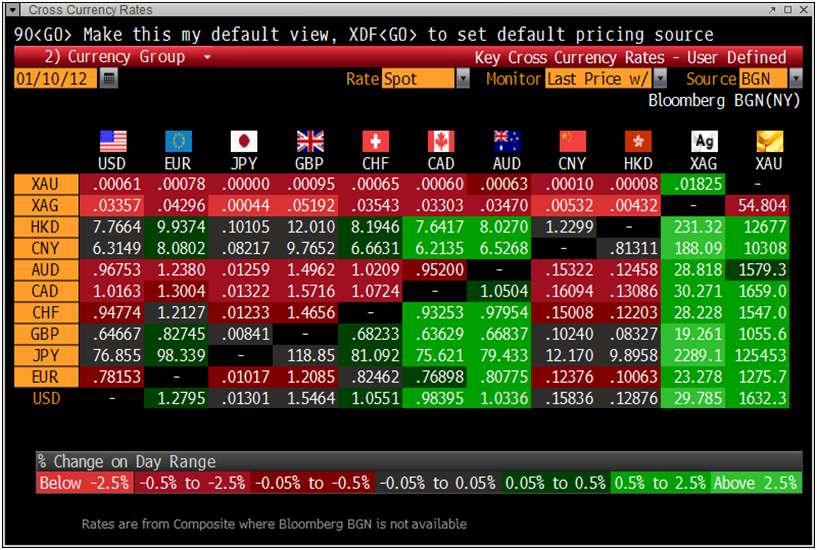

Gold’s London AM fix this morning was USD 1,627.00, GBP 1,051.91, and EUR 1,271.49 per ounce.

Yesterday's AM fix was USD 1,618.00, GBP 1,047.38, and EUR 1,266.54 per ounce.

Cross Currency Table

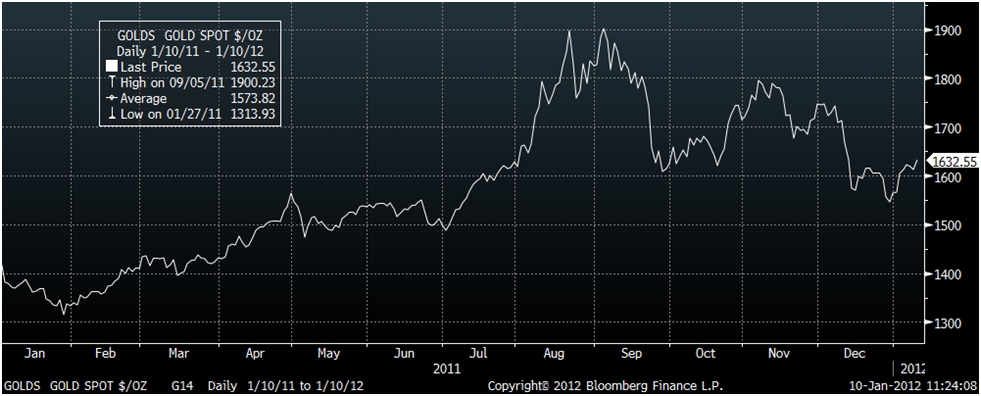

Gold Spot $/oz - 5 days

Today the Troika (officials from the IMF, ECB & European Commision) return to Ireland for its quarterly review. Over the next ten days they will determine if Ireland is implementing its bailout programme properly but there are already calls for a second 'bailout'. Eurozone bond auctions will show whether investors are willing to put more money into the debt ridden European nations of Spain and Italy on Thursday and Friday respectively.

Demand for gold bullion continues to be robust in the EU due to concerns about the euro. In Asia, demand has not risen significantly yet but is expected to in the coming days in the run up to Chinese New Year.

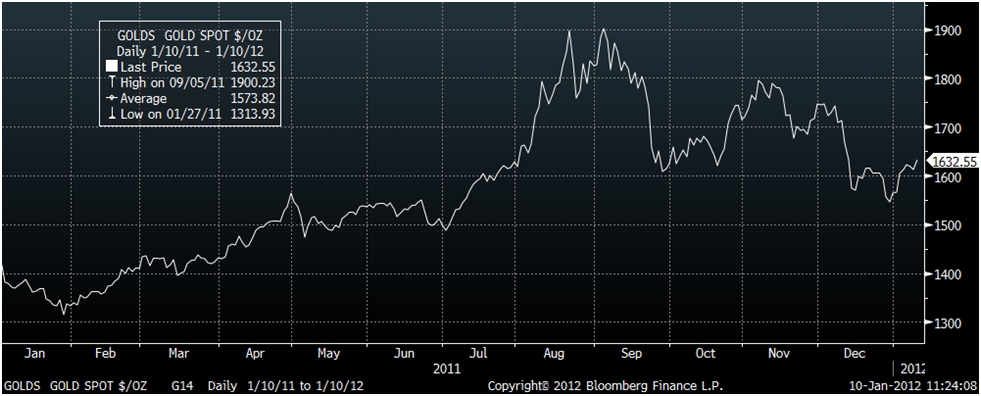

Gold Spot $/oz - 1 year

Goldman Sachs Group Inc. and Morgan Stanley yesterday reiterated their pick of gold as a favored commodity this year, as investors seek to protect their portfolios against the unrest in financial markets. Edel Tully, analyst from UBS predicts gold will reach $2,500/oz in 2012 and will average $2,050/oz - 26% above the current price.

Turmoil within financial markets continues to pave the way for gold to shine in 2012. Gold remains key for diversification in portfolio management.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWS

(Reuters)

Gold firms; euro zone concerns remain

(BusinessWeek)

Gold Advances for First Day in Three on Europe Crisis Optimism

(Bloomberg)

Gold Could Hit $1,940 an Ounce in ’12: Goldman

(Der Spiegel)

Fearful Investors Stash Money in Luxury Goods

(Reuters)

India allows more banks to import gold, silver

(USA Today)

U.S. debt is now equal to economy

COMMENTARY

(Infographic)

Infographic: $8.5 Trillion Bullion vs. $750 Trillion Derivatives

(KingWorldNews)

James Turk - There is a War Going on in the Gold Market

(Wall Street Journal)

Gold Tipped to Keep on Shining

(Minyanville)

Precious Metals Sector Sees Major Bottom

(Foreign Policy Journal)

The Dismal Economic Outlook For The New Year

(MarketWatch)

Investors should root for the gold bugs