The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.As Chinese people's disposable incomes gain and concerns grow over inflation and equity and property markets, Chinese consumers and investors are turning to gold as a long term investment hedge.

There is informed speculation that commercial Chinese banks may have taken advantage of the recent price dip to build stocks of coins and bars and accumulate bullion.

China's demand for physical gold bullion has rocketed past India with the country now overtaking India in the third quarter as the largest gold jewellery market according to the World Gold Council.

There is also informed speculation that some of the buying was from the People's Bank of China with one analyst telling Bloomberg that “there is always the possibility that some purchases were made by the central bank.”

From Goldcore:

Gold’s London AM fix this morning was USD 1,641.00, GBP 1,063.51, and EUR 1,286.25 per ounce.

Yesterday's AM fix was USD 1,627.00, GBP 1,051.91, and EUR 1,271.49 per ounce.

Cross Currency Table

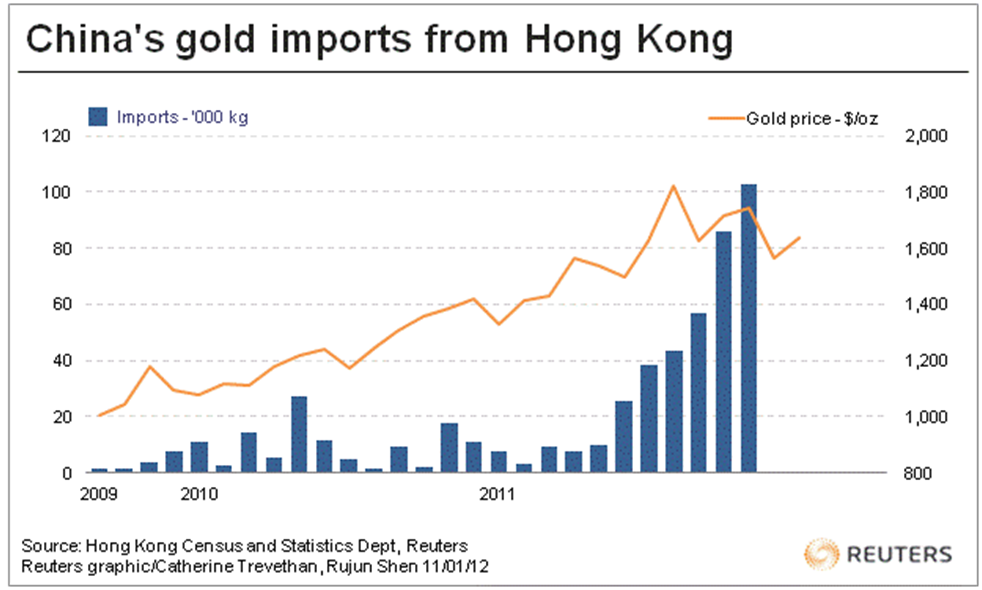

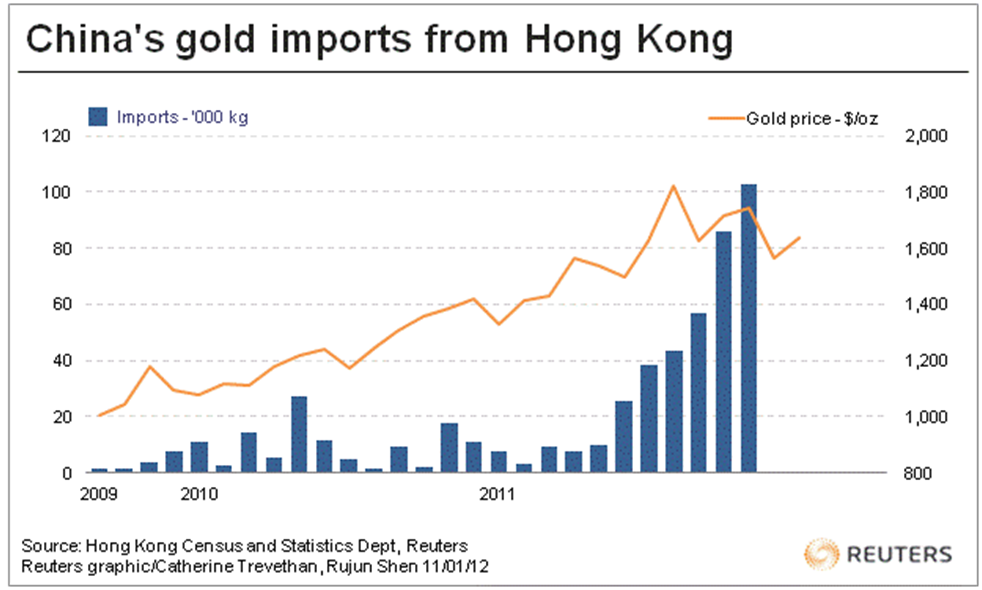

Demand for gold bullion in China continues to surge.

Mainland China's imports from Hong Kong surged to 102,779kg/oz from 86,299kg/oz in October. This is a 20% increase from the already high number seen in October and a 483% y/y increase.

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.

As Chinese people's disposable incomes gain and concerns grow over inflation and equity and property markets, Chinese consumers and investors are turning to gold as a long term investment hedge.

There is informed speculation that commercial Chinese banks may have taken advantage of the recent price dip to build stocks of coins and bars and accumulate bullion.

China's demand for physical gold bullion has rocketed past India with the country now overtaking India in the third quarter as the largest gold jewellery market according to the World Gold Council.

There is also informed speculation that some of the buying was from the People's Bank of China with one analyst telling Bloomberg that “there is always the possibility that some purchases were made by the central bank.”

As we've stated in the past, the PBOC is gradually diversifying their huge FX reserves and likely will announce upward revision of total gold reserves again in the coming months. Whether official buying is responsible for the huge surge in gold imports from Hong Kong is more difficult to ascertain The Chinese Central Bank does not release their figures on gold purchases.

As of June, 30, 2009, they held 33.59 million ounces or 1,054 tons. This is the 5th largest holding by country but some officials are on record with regard to Chinese aspirations to hold as much gold as the Federal Reserve's 8,100 tonnes of gold reserves.

What is particularly bullish about the import data is that there is a ban on exporting gold from China so gold bullion is in strong hands in China.

Platinum group metals rose a third straight day due to concerns on supply disruption in South Africa, as the national grid warned about extremely tight power supply in January. The gold-platinum spread narrowed to just below $165 an ounce, its smallest in two weeks. The price of platinum has been lower than that of gold since September 2011, as gloomy economic outlook dampened sentiment on platinum, while gold's safe-haven appeal helped limit its price decline.

Gold Spot $/oz - 5 Days

Finally, markets were looking forward to a meeting between German Chancellor Angela Merkel and Italian Prime Minister Mario Monti later in the day in Berlin, while IMF's Christine Lagarde, is to meet French President Nicolas Sarkozy in Paris. Markets are also watching Spain and Italy’s plan to sell as much as EUR17 billion in debt on Thursday and Friday respectively.

The continuation of the eurozone crisis and risk of global financial contagion will continue to support gold's safe haven status.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWS

(Reuters)

Gold edges up as Europe uncertainty supports

(TheStreet)

Gold Prices Reclaim Their Luster

(CoinNews)

Gold Prices Advance $23, Silver Eagle Sales Top 4.2 Million

COMMENTARY

(The Telegraph)

Can the Euro Survive Another Year?

(SkyNews)

Will The ECB's Stealth QE Programme Save The Euro?

(SilverSeek)

Three Elements of Manipulation

(Mineweb)

More banks in India to import gold, silver

(ZeroHedge)

Was 2011 A Dud Or A Springboard For Gold?