From Goldcore:

Gold is trading at USD 1,665.10, EUR 1,261.20, GBP 1,067.30, CHF 1,557.40, JPY 129,550 and AUD 1,643.0 per ounce.

Gold’s London AM fix this morning was USD 1,665.00, GBP 1,068.75, and EUR 1,262.22 per ounce.

Yesterday's AM fix was USD 1,680.00, GBP 1,077.06, and EUR 1,266.49 per ounce.

Gold in USD – 1 Yr (100, 144, 200 DMA – yellow line at $1,618/oz)

Gold fell 2.6% in US dollar terms yesterday on low volumes as technical selling led to price falls which were exacerbated by a number of stop levels getting hit. The falls may be due to banks raising capital due to liquidity and solvency issues.

Gold’s weakness yesterday was primarily a function of dollar strength. This meant that gold’s falls in euros, pounds and other currencies was much smaller (between 1% and 2% in most currencies) and gold fell less in euros than did the DAX and CAC equity indices.

The technical situation has deteriorated. The 144 day moving average which has provided good support for 2 years was breached yesterday and the 200 day moving average at $1,618/oz now becomes support.

Absolutely nothing has changed with regard to the fundamentals driving the gold market. Investment demand for physical bullion remains robust internationally.

Real macroeconomic, systemic and monetary risk remains and will support gold.

There are signs that demand in India and China is picking up again after the latest correction. Bullion dealers in India report bargain hunters again buying on the dip.

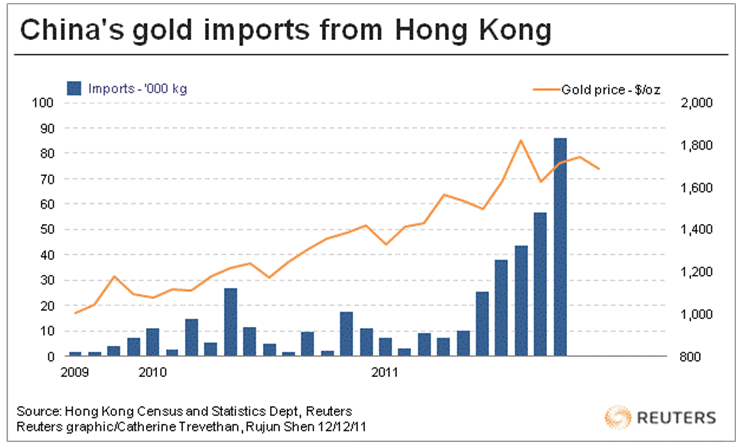

Chinese citizens continue to buy gold in record volumes with October the fourth successive record month for imports via Hong Kong (see table above).

The October total was 85.7 tonnes –up very significantly on the September figure which was itself a new record. The October demand was a massive 40 times higher than imports via this route a year ago.

It is the fourth successive month of record imports into China and overall imports through Hong Kong for the first 10 months of the year are around three times higher than a year ago.

Of importance is the fact that the amount of gold imported through Hong Kong amounted to over a quarter of estimated global demand for the yellow metal – as noted by Mineweb.

Premiums in Hong Kong and Singapore (see chart above) are likely to stabilise near the $1.00 per ounce level as Chinese buyers are likely to again buy on weakness – especially as dealers and jewelers will soon be buying stock prior to Chinese New Year at the end of January.

Cross Currency Table

OTHER NEWS

(Bloomberg) -- Gold Will Average $2,050 an Ounce in 2012, SEB Banking

Gold will average $2,050 an ounce next year, SEB Merchant Banking, a unit of Skandinaviska Enskilda Banken AB, said today in an e-mailed report. “Additional outbreaks of volatility should be expected in coming months during flights to liquidity with the European crisis still in a critical phase and the effects of Chinese monetary tightening topping out,” the bank said in the report.

(Bloomberg) -- China’s Gold Imports From Hong Kong Surge 51% on Haven Demand

China’s gold imports from Hong Kong surged 51% to a record in October as investors sought to hedge against turmoil in the financial markets and took advantage of the price gap between the two places.

Mainland China bought 86,299 kilograms (86.3 metric tons) from Hong Kong in October, up from 56,977 kilograms in September, according to the Census and Statistics Department of the Hong Kong government. China doesn’t publish gold trade data. The country imported more than 300 tons for all of 2010, People’s Bank of China Vice Governor Yi Gang said in February.

China’s bullion demand may be more than 750 tons this year, as the country overtook India in the third quarter as the world’s largest gold jewelry market, according to the World Gold Council. The amount includes more than 250 tons of investment demand and 500 tons of jewelry demand, said Albert Cheng, managing director for the far east region at the Council, said on Nov. 17.

“As economies in the West falter, China’s growth will moderate and many people just want to put their money somewhere safe,” said Duan Shihua, Shanghai-based head of corporate services at Haitong Futures Co., China’s largest brokerage by registered capital. The arbitrage between Shanghai and Hong Kong also aided demand, he said.

Prices in Hong Kong mostly traded at a discount to those in China in October, making imports profitable for traders who seek to exploit price gaps. Gold for immediate delivery of 99.99 percent purity on the Shanghai Gold Exchange traded at 339.40 yuan a gram ($1,661 an ounce), compared with 416.60 Hong Kong dollars (340.72 yuan) on the Chinese Gold & Silver Exchange Society.

(Bloomberg) -- UBS’s Physical Gold Flows to India Yesterday Most Since Oct. 20

UBS AG’s physical gold flows to India yesterday were “well above” average and the most since Oct. 20, Edel Tully, an analyst at the bank, wrote today in an e-mailed report.

(Bloomberg) -- Gold Is in the Start of a Bear Market, Economist Gartman Says

Gold is in the “beginnings of a real bear market,” economist Dennis Gartman said today in his daily Gartman Letter. The metal may extend declines to $1,475 an ounce, he said. It traded at $1,663.80 an ounce by 8:24 a.m. in London.

(GoldCore Editors note) – Gartman has been extremely inconsistent regarding gold in recent years. He has swung from being bullish on gold in all currencies to being bearish on gold in all currencies on a number of occasions. This is the second time that he has said that gold’s bubble had popped and we are now in a bear market.

Gartman is a trader and is followed by hedge funds and prop desks of banks and does not appear to understand the proven diversification benefits gold brings to a portfolio.

In November 2009, Gartman said that there “is a gold bubble.” Gartman said that to say otherwise was “naïve”. Gold was trading at $1,100/oz at the time.

In August 2011, Gartman said that gold was the biggest bubble of our lifetime.

Inconsistently, only last week, Gartman said on CNBC that he is “long gold” and has been for “six or seven months”.

Gartman’s short term calls on gold and silver have been wrong more often than not in recent years. He tends to turn bearish after gold has already experienced a correction and is close to bottoming.

Those wishing to diversify and add gold to their portfolio will use his call as a contrarian signal that we may be getting close to a low in this most recent sell off.

Our advice is to ignore gurus, price predictions and noise – up and down – and focus on the real fundamentals driving the gold market.

Having an allocation to and owning physical gold will again protect and preserve wealth in 2012.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $31.30/oz, €23.70/oz and £20.07/oz

PLATINUM GROUP METALS

Platinum is trading at $1,489.25/oz, palladium at $657.50/oz and rhodium at $1,425oz.

NEWS

(Reuters)

Gold steady after sell-off; Europe woes in focus

(Reuters India)

Gold price drop prompts buying, but caution prevails

(Financial Times)

Chinese gold imports from HK hit record

COMMENTARY

(Casey Research)

Gold and Silver Pullbacks in Perspective

(Forbes)

Central Bank Appetite And The Monetary Case For $10,000 Gold

(The Telegraph)

From Mr Copper to Choc Finger: Famous Commodity Squeezes

(You Tube)

Pan For Gold On The Streets Of New York City

(Armstrong Economics)

Why MF Global is Worse Than Europe

(New York Times)

Krugman: Debasing The Dollar, Not