From Goldcore:

Gold is trading at USD 1,790.10, EUR 1,300.60, GBP 1,114.30, CHF 1,606.20, JPY 139,690 and CNY 11,362 per ounce.

Gold’s London AM fix this morning was USD 1,794.00, GBP 1,114.49, and EUR 1,301.51 per ounce.

Yesterday's AM fix was USD 1,764.00, GBP 1,102.78, and EUR 1,286.65 per ounce.

Gold remains firm in all currencies after yesterday’s sharp gains which saw gold rise 2% in dollar and euro terms and nearly 4% in Swiss franc terms.

Gold appears to be breaking out after another period of correction and consolidation. We have now had a higher monthly close in October and two consecutive higher weekly closes. This strongly suggests the short term trend is again aligned with the long term trend of a secular bull market.

Record nominal highs seem likely given the strong fundamentals and improved technical picture – possibly as soon as before the end of 2011.

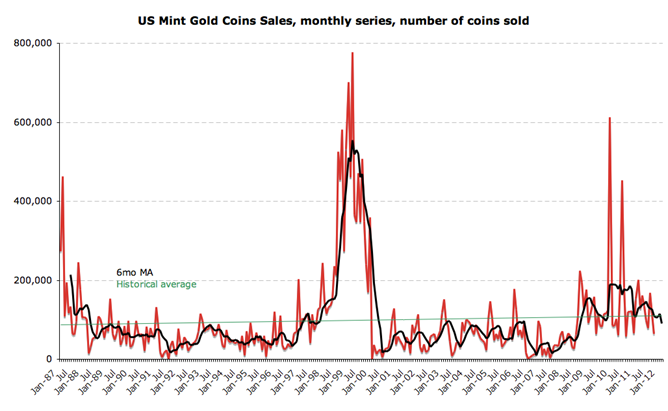

US Mint Gold Coin Sales Data and Research Casts Doubt on ‘Gold Bubble’ Thesis

US Mint gold coin sales fell in October leading to further speculation that this was another sign that the gold bull market was over.

Rather than idle speculation it is important to look at the facts and analyze them.

Dr. Constantin Gurdgiev, a non Executive member of the GoldCore Investment Committee, has analyzed the data of US Mint coin sales in October and has looked at them in their important historical context going back to 1987.

Dr. Gurdgiev writes “In recent weeks there was some long-expected noises coming out of the gold 'bears' quick to pounce on the allegedly 'collapsing' sales of gold coins by the US mint. I resisted the temptation to make premature conclusions until the full monthly sales data for October is in. At last, we now can make some analytical observations.“

The thesis advanced by the 'bears' is that October sales declines (for US Mint sales of new coins) are:

1. Profoundly deep

2. Consistent with 'gold bubble is bursting at last' environment and

3. Significantly out of line with previous trends, and

4. Changes are reflective of buyers exiting the market on the back of high gold prices

Dr. Gurdgiev concludes that “We are seeing a well-predicted reversion to the mean along upward trend in demand. We are also seeing, in my opinion, gold coins doing exactly what gold in general is expected to do - providing long term hedge instrument against risks associated with other asset classes.”

The data since 1987 until today and the evidence from the US Mint regarding the behaviorally anchored, long term demand for gold coins as wealth preservation tool for retail investors does not support the view of dramatic over buying of gold or piling into gold by ‘Joe Public’, the shoeshine boys or the fabled speculatively crazed retail investor that some commentators suggest is happening today.

The man and woman in the street in the western world continues to be a bigger seller of gold (jewellery into scrap) than buyer as seen in the western world phenomenon that is ‘cash for gold’.

The excellent research on US Mint gold coin sales in October and going back to 1987 by Dr Constantin Gurdgiev can be read here.

China’s Gold Imports Jump Sixfold

Chinese gold imports from Hong Kong rose 30% month on month in September to a record 57 tonnes.

Since May, shipments to the mainland have risen a massive six fold, according to data from the HK Census and Statistics Department.

China’s demand for gold is a game changer which is as of yet largely unacknowledged. It has not been reported on at all in the non specialist financial media. The vital fact that the per capita consumption of 1.3 billion people is increasing from a near zero base is still not appreciated.

Gold ownership in China remains very small vis-à-vis their neighbours in India due to the banning of gold ownership in China from 1950 to 2003. Therefore, the huge increase in demand seen in recent years is sustainable and will continue to be seen in the coming years due to the very important cultural affinity Chinese people throughout the world have for gold.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $34.79/oz, €25.22/oz and £21.65/oz

PLATINUM GROUP METALS

Platinum is trading at $1,657.70/oz, palladium at $672.50/oz and rhodium at $1,525/oz.

NEWS

(Businessweek)

Gold Drops After Reaching 7-Week High on European Debt Risk

(Reuters)

Gold steady on mounting Italy debt worry

(Financial Times)

China’s Gold Imports Jump Sixfold

(Businessweek)

UN Report May Show Iran Is Moving Closer to Nuclear Bomb

(Bloomberg)

Oil Rises to Three-Month High on Signs of Shrinking U.S. Stocks

COMMENTARY

(True Economics)

Dr. Constantin Gurdgiev - US Mint Sales for October

(Mineweb)

The More Gold the West Sells the More China is Buying

(Mineweb)

Gold and Silver - Positive Outlook for Sometime to Come

(ZeroHedge)

China Takes Advantage Of September Price Drop; Imports Record Amount Of Gold

(ZeroHedge)

Where Are We Now? A Comparative Timeline Approach

(Jesse’s Cafe American)

GATA: The Men In the Arena

(321Gold)

Richard Russell We Love You, Get Well Soon

(Wall Street Journal)

Gold Dealer Accused of ‘Bait and Switch’