Gold’s London AM fix this morning was USD 1,896.50, EUR 1,341.13, and GBP 1,174.67 per ounce. The gold fix was higher than Friday’s in all currencies (USD 1,854.00, EUR 1,301.23, and GBP 1,143.81 per ounce). Despite continuing denial, a recession in the U.S. is inevitable; the question is only with regard to how deep the recession is and to the nature of the recession – inflationary, stagflationary, hyperinflationary or deflationary. The consensus, especially amongst Keynesians, is that deflation is most likely. However, given the degree of currency debasement being seen internationally stagflation is also a risk. Hyperinflation, as being experienced in Belarus today, is the macroeconomic and monetary ‘black swan’. There are growing concerns that the Eurozone crisis might degenerate again soon due to the Greek debt crisis and risk of default. Over the weekend talks between Greece, the IMF and ECB representatives over new bailout funds broke down. The euro has fallen and the German local elections have added to concerns over Greece.

From Goldcore:

Spot for immediate delivery rose to $1,903.00/oz as the dollar and all currencies fell against gold in early European trading. Risk aversion has returned due to concerns about the US and global economy and Eurozone contagion.

Gold is trading at USD 1,890.50, EUR 1,339.10, GBP 1,171.30, CHF 1,486.50 and JPY 145,350 per ounce.

Cross Currency Table

Gold’s London AM fix this morning was USD 1,896.50, EUR 1,341.13, and GBP 1,174.67 per ounce. The gold fix was higher than Friday’s in all currencies (USD 1,854.00, EUR 1,301.23, and GBP 1,143.81 per ounce).

The very poor employment figure in the United States has led to stock markets in Asia and Europe experiencing quite large falls. Also the exposure of the world’s largest banks to lawsuits which could cost billions is causing market jitters.

Despite continuing denial, a recession in the U.S. is inevitable; the question is only with regard to how deep the recession is and to the nature of the recession – inflationary, stagflationary, hyperinflationary or deflationary.

The consensus, especially amongst Keynesians, is that deflation is most likely. However, given the degree of currency debasement being seen internationally stagflation is also a risk.

Hyperinflation, as being experienced in Belarus today, is the macroeconomic and monetary ‘black swan’.

There are growing concerns that the Eurozone crisis might degenerate again soon due to the Greek debt crisis and risk of default. Over the weekend talks between Greece, the IMF and ECB representatives over new bailout funds broke down.

The euro has fallen and the German local elections have added to concerns over Greece.

Exit polls suggest that Merkel’s ruling CDU has lost support ahead of parliamentary vote on Eurozone temporary bailout mechanism. There is also increasing speculation that she is preparing for a political farewell.

On Wednesday morning, Germany's Federal Constitutional Court will deliver its ruling - awaited for over a year - on suits claiming Berlin is breaking German law and European treaties by contributing to multi-billion euro bailouts of Greece, Ireland and Portugal.

There is a real risk that politics in Germany may soon lead to end of the European Monetary Union and euro as we know it.

People’s Bank of China

Over the weekend, Zero Hedge picked up on the most recent batch of Wikileaks revelations showing cables from the United States embassy in China to State Department officials in Washington in 2009.

The cable summarizes several commentaries in Chinese news media. One of those commentaries is attributed to the Chinese newspaper Shijie Xinwenbao (World News Journal), published by the Chinese government's foreign radio service, China Radio International. The cable's summary reads:

“The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or euro.

Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries toward reserving more gold.

Large gold reserves are also beneficial in promoting the internationalization of the renminbi."

The cables suggest that China sees gold as a valuable monetary and indeed geopolitical asset in order to further their aims to rival the U.S.A. as a global economic power. Something that we have long warned of.

The People’s Bank of China’s aims in this regard and their massive increase in gold reserves in recent years, is one of the elephants in the room ignored by many analysts and so called experts.

Even after nearly doubling their gold reserves to become the world's fifth-biggest holder of the precious metal - from 600 tonnes in 2003, to over 1,054 tonnes (announced in 2008), China still has less than 2% of its currency reserves in gold in marked contrast to most other large industrial nations including the U.S. (http://en.wikipedia.org/wiki/Gold_reserves).

The Chinese are nervous about the debasement of their $3 trillion ($3,000,000,0000,000) worth of U.S. debt and are continuing to diversify their currency reserves.

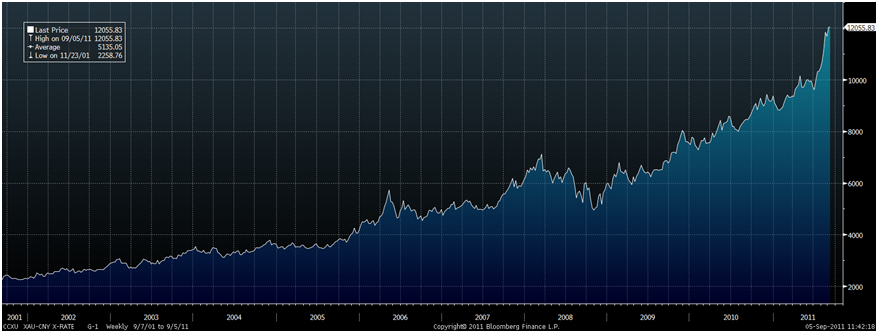

Gold in Chinese Yuan (CNY) – 10 Year (Weekly)

In late 2010, a Chinese Chamber of International Commerce researcher said that China should "eventually boost its gold reserves to a level equal to that held by the United States".

China's reported gold reserves total 1054 tonnes, a fraction of the 8133 tonnes held by the U.S.

Given the recent diplomatic tension between the U.S. and China (Tibet, Taiwan, Libya and Iran) there is an important geopolitical dimension to this story that is worth watching.

China has diplomatically communicated to the U.S. financial authorities that they expect US monetary economic policies to be responsible and that the vast Chinese dollar holdings not be devalued.

Chinese diversification into gold will continue but the Chinese will continue to do so under the radar and will not broadcast their intentions for fear of driving down the dollar and up gold prices and then having to chase the gold market.

Far better to slowly and gradually pursue a policy of reserve diversification thereby accumulating gold without spooking markets are causing the gold price to surge.

This is likely the strategy of other creditor nation central banks and even many billionaires internationally.

China's intentions with regard to positioning the yuan as a global reserve currency have been declared by many officials.

China wishes to internationalize the yuan by having important commodities such as gold traded in yuan. An official from the People's Bank of China said in May 2010 that China should develop more yuan-denominated gold investment products for 30 trillion yuan in savings the country has.

The official said that China's trading in yuan-denominated gold investment products boosts the internationalization of the currency and the country, stating

“A currency's international status depends on its being accepted in trade and settlement and having certain international commodities denominated in that currency helps China's goal to internationalize the yuan. Gold is a good choice to have yuan trading.”

China has been less vocal regarding the trading of oil in yuan or renminbi, but this is a likely policy goal and could potentially threaten the petrodollar and thus the dollar's reserve currency status.

Indeed, China has already done bilateral deals to buy oil and gas from some producing nations with yuan.

Speculation that the euro could supplant the petrodollar and the dollar as global reserve currency are now well and truly dead.

China's growing political and economic clout, and the fact that it is the world's largest creditor nation mean that its currency poses a long-term threat to the dollar as global reserve currency.

Should geopolitical tensions continue to escalate between the U.S. and China, then the Chinese could use the gold and wider currencies market in a currency war.

Such threats to the dollar and growing concerns about fiat currencies internationally, mean that gold is likely to continue rising for the foreseeable future, and the inflation adjusted high of $2,500 per ounce looks inevitable.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $42.52/oz, €30.10/oz and £26.35/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,871.50/oz, palladium at $763/oz and rhodium at $1,800/oz.

NEWS

(Bloomberg)

Gold Climbs Above $1,900 as Concern About Slowing Economies Stokes Demand

(Reuters)

Gold edges lower; growth worry supports

(The Telegraph)

RBS faces billion dollar bill in US lawsuit

(Reuters)

QE3 no silver bullet for markets

(Bloomberg)

BofA, JPMorgan Among 17 Banks Sued by U.S.

COMMENTARY

(Zero Hedge)

Wikileaks Discloses The Reason(s) Behind China's Shadow Gold Buying Spree

(MarketWatch)

Commentary: Gold climbs back - Gold bugs cheers bounce-back

(Business Insider)

MAULDIN: It's All About The Jobs -- And Gold

(GoldSeek)

China knows about gold price suppression, and U.S. knows China knows

(GoldSeek)

MIDAS SPECIAL - WikiLeaks/US Embassy In Beijing Price Suppression Cable/China/GATA On The Move In Hong Kong And London

(Financial Times)

The Worst of the Euro Crisis is Yet to Come