Good article (Martin Armstrong's Gold Update). I'm pretty sure any change this huge to the monetary system would be jarring and probably would lead to depression. Is it possible for gold & silver to not be pegged to a constant government $ value but still used in daily commerce? Isn't that the way it was done in the past?

Anonymous writes:

Doc,

How does Martin Armstrong know that a return to the gold standard is the banksters plan?

Return to Gold. Isn't this what Ron Paul is advocating?! Do you agree? Or, you don't really know..

Thanks for the article!

The Doc:

A return to a gold standard is much different than a return to free gold/ free silver. If the government fixes gold and silver arbitrarily in price at a set ratio...economic distortions will always appear.

A government decree fixing the ratio of gold to silver will necessarily always overvalue one metal vs the other.

Just look at American history when the price of silver was fixed vs. gold.

When silver is overvalued the market will exchange their silver for gold, creating a shortage of gold. This happened in America in the 1840's, when the government over-valued silver to benefit their constituents, who were silver

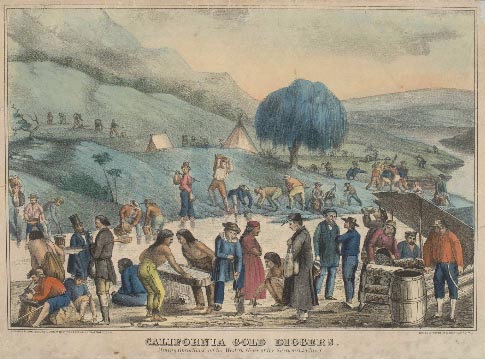

miners. The silver miners had been suffering badly so to 'fix' the problem, the government raised the official value of silver vs. gold. Following Gresham's law, silver poured into the US from all over the globe, draining US gold supplies and creating a massive US shortage of gold. The result of this massive gold drain (thanks to politicians thinking they could determine the value of silver) was the California '49er gold rush.

miners. The silver miners had been suffering badly so to 'fix' the problem, the government raised the official value of silver vs. gold. Following Gresham's law, silver poured into the US from all over the globe, draining US gold supplies and creating a massive US shortage of gold. The result of this massive gold drain (thanks to politicians thinking they could determine the value of silver) was the California '49er gold rush. When gold is arbitrarily overvalued vs. silver, the exact opposite occurs, and the free market drives silver into shortage.

The government should mint gold and silver, and specify the purity and weight of the coins, and let the free market determine the value of both silver and gold vs. goods, labor, and commodities.

Basically this would consist in the US government minting official US coins in fractional oz denominations, without any printed dollar value.

The best description of this system is a simple explanation: free gold/free silver.

If our entire debt plagued system was overhauled and placed back on a gold standard, without all debts being first being forgiven in a jubilee, a massive depression would be induced as a result of everyone's debt instantly becoming owed in the new stronger currency, gold.

This actually occurred in the US following the Crime of '73 (1873) in which the banksters demonitized silver, creating a gold only standard. The result was a severe depression in the 1890's.

Martin Armstrong's point is that this is why the Euro experiment is failing, because they made this exact mistake.

When all of the Euro nations joined the Euro and dropped their national currencies, their debts were converted from liras, drachmas, deutschmarks etc, INTO EURO DENOMINATED DEBTS! The stronger Euro made repayment of these debts impossible, as the currency strengthened, meaning the debts increased exponentially in real value!

If the Euro would have allowed member nations' debts to be forgiven prior to their entrance into the Euro, the Euro would not be having the crisis it finds itself in today.

If the US or world were to return to a gold standard (without a complete debt forgiveness jubilee episode), the population's massive debts could be converted into GOLD DEBTS BY GOV'T DECREE, which would then appreciate vs. the weaker dollar/euro currencies, etc, causing a massive increase in the REAL DEBT LIABILITY!

Think about this for a moment...the average Joe's mortgage, 3 auto loans, credit card debt, HELOC loan, student loan, etc, are all suddenly owed to the banksters in solid gold!

This is why a return to a gold standard is the banksters' dream and ultimate end game- because this would result in the population being required to pay the banksters back in SOLID GOLD for fiat paper created out of thin air and loaned out at interest to the masses! The ultimate purpose of banksters making easy to obtain loans that are printed into existence is to DEMAND REAL PHYSICAL ASSETS when the debtor defaults on his obligations! Look at what is happening in Greece! The Greeks can't pay back their loans, so the banksters are going after the tangible assets such as the Greek islands and national silver store!

Now, if a debt jubilee was allowed to occur prior to the implementation of the new gold standard things might work at least for awhile, although by fixing the value of gold vs. silver the gov't would necessarily again create extreme shortages of whichever metal was undervalued, again likely eventually resulting in a depression or severe recession.

The alternative is government (or private mints) minting gold and silver and guaranteeing the weight and purity of the coins, and allowing the free market to determine their worth versus other assets, labor, and commodities. In such a system bankers would have to work for and earn a proper living, instead of stealing and confiscating the wealth of the world.

This would be considered free gold and free silver, and would result in unmatched economic prosperity for the masses, as well as America as a whole.