Avery Goodman takes a look at JPM's actions, and gives an excellent analysis of platinum's supply/demand fundamentals.

From SeekingAlpha

JPMorgan Chase (JPM) is the biggest derivatives issuer of all U.S. banks, but it is busy below the radar, loading up its vaults with 50 troy ounce platinum bars. JPMorgan has been a large net physical platinum buyer in 2011, and it was also a big buyer in 2010.

In 2010 the bank "stopped" a total of 975 platinum contracts, while delivering only 463, resulting in a net accumulation of 512 contracts, representing 25,600 troy ounces of platinum. In 2011, the delivery pace increased substantially. In January, 2011, JPM took delivery of 333 contracts, representing approximately 16,650 troy ounces of platinum. That month, a sum total of only 527 contracts were delivered to all clearing members, leaving JPM with 63% of all the delivered platinum at NYMEX. Then, in March, JPM took delivery of 12 more contract, even though it was a nonstandard “off-month” for platinum futures contracts. The off-month adventure added another 600 troy ounces to its kitty.

As of April 8, 2011, about 680 total platinum contracts were delivered at NYMEX. Of those, 307 contracts, 15,350 troy ounces, or over $27 million worth of platinum went to JPM. There are still over 100 April contracts left to be delivered, so it is likely that JPM’s gross intake will likely rise further this month. Set against these stoppages[i], are a mere 101 deliveries, so net 2011 intake has been 551 contracts, 27,550 troy ounces, more than $49 million worth of the precious white metal - even though the year has barely begun! [ii] So far, combining this year and last, noting that the April NYMEX delivery month is not yet over, JPM has accumulated approximately $76 million worth of physical platinum bars. That does not count any bars that may have been delivered to it at the secretive London Platinum and Palladium Market Association (LPPM).

The platinum "market" is bigger than that, but most of it is actually made up of a combination of derivatives and unallocated storage schemes. In other words, $76 million in physical platinum is a huge amount for anyone, except, perhaps, a big international auto/truck manufacturer to buy in about 12 months. This raises a few questions. Who exactly, within the JPM-Universe, is accumulating physical platinum through NYMEX deliveries? Is it the bank itself? Or, is it one or more of its customers? According to the bank, it closed its proprietary trading division back in October 2010.

Rumor has it, however, that most of the positions and the executives were simply transferred to closely related hedge funds. But, in any event, accumulation of physical platinum started last year when JPM's proprietary trading division was very actively operating. So, chances are that the accumulation of platinum bars is a bank decision, not one from its customers.

Why is JPMorgan Chase taking physical delivery of platinum? Why not simply open OTC or futures exchange "long" positions and "roll" them over and over again to the next delivery period, never taking physical delivery, as so many large speculative players do? JPMorgan Chase is, to some extent, repudiating the very concept of derivatives by doing this, even though it remains one of the premiere gambling “houses” in the world's most important “casinos” (a/k/a futures and OTC derivatives "exchanges").

A very interesting schism now exists between JPMorgan Chase and Goldman Sachs (GS). Goldman Sachs has been busy advising clients to dump platinum. On Monday, April 11, 2011, Goldman advised clients to close a profitable long commodity position that including both crude oil and platinum. While they are saying that, JPM is taking delivery. But taking delivery implies an intention to hold a position for a very long time. It is possible for both JPM (in the long run) and GS (in the short run) to be right. Generally speaking, however, we ignore the public pronouncements and recommendations of big investment houses. They are usually so filled with conflicts of interest as to be worthless. In this case, we don't know what J.P. Morgan has been advising its clients to do. We do know what it is doing.

We have seen over the past few years that advice often runs opposite to what bank executives are doing with their own portfolios. Advice can be motivated by factors other than the best interest of public clients. For this reason, we are careful NOT to listen to what they say, but, rather, we pay careful attention to what they do. JPMorgan Chase is buying platinum...a lot of it. They are buying it in the form of physical bars, rather than derivatives. This buying will continue to diminish the supply of a very rare metal, putting intense long term upward pressure on prices. That is because only a finite amount of platinum is mined every year. Total mine supply is about 6.1 milion ounces per year, which is about 14.7 times less than the amount of gold taken from the ground each year. Derivatives, in contrast, can be manufactured at will, in whatever quantity is needed to manipulate markets into believing that more supply exists than really does. It seems to me that JPM would not be taking physical delivery unless it believed that the age in which derivatives dominated the precious metals markets is close to being over.

On the other hand, it is impossible to say how big the JPM OTC and/or exchange traded platinum long position in derivatives might be. Maybe, it is huge, many times bigger than deliveries it is taking. England's London's Platinum and Palladium Market (LPPM) is a notoriously opaque organization, with a penchant for secrecy, much like the London Bullion Market Association (LBMA). They'll never tell. NYMEX is not quite so secrective, but the CFTC refuses to disclose the positions of big banks, even when they are large enough to profoundly affect the direction of markets in the short run. JPM's derivatives positions are unknown. But, one thing is clear. When you take delivery of physical precious metals, you pay in full. The metal it is acquiring is going to become a part of its Tier 1 asset base. It is not a leveraged investment. If other banks follow in its footsteps, and at least one, Deutsche Bank (DB), seems to be doing just that, platinum may join gold as a "financial asset" rather than a mere commodity.

Regardless of JPMorgan Chase and/or Goldman Sachs, platinum’s fundamentals are remarkably bullish. Even assuming the worst in terms of auto sales, and a total cessation of all “QE” counterfeiting operations by the Federal Reserve, by our calculations, the platinum market should still be in mild deficit by late 2011, and in severe deficit by 2012-2013. If Japan manages to get its auto parts factories online again and/or the Federal Reserve announces QE-3 or continues with QE-Lite, platinum will go into deficit faster and more severely. Actually, in the medium term, the Japanese quakes and tsunami are positives for platinum even though they are negatives for its sister metal palladium. Platinum's use as an anti-pollution catalyst is now almost exclusively restricted to diesel engines. Perhaps, car sales will be lower in the next few months. But, a lot of heavy trucks and earth moving equipment are going to be used to rebuild. We are going to see an increase in Japanese heavy truck manufacturing. That means more diesel engines, if we turn a blind eye to the tragedy, and look only at platinum prices, it is clear that it will have a positive effect.

In making these calculations, we have not yet even considered the so-called “indiginization” program in Zimbabwe. The eventual decline in Zimbabwean production makes soaring platinum prices a virtual certainty within a year or two, even without consideration of Japan and the Fed. Zimbabwe is the only place left where new deposits of platinum can be mined at a reasonable cost. The corrupt government of Robert Mugabe, however, is making it unprofitable for miners to operate there. If that situation does not resolve very quickly, it will remove expected additional supplies over the next few years, creating a more severe shortage, sooner than previously predicted.

We expect the price of platinum to climb very high over the next few years, in real terms. This will happen regardless of whether the dollar and/or the stock market rises or collapses, in the face of inflation or deflation, and without regard to Japan, the Fed or Zimbabwe. The traders at JPMorgan Chase, apparently, agree with us. You can learn more about the fundamentals of the platinum market here. Up until now, platinum has been the wall-flower of the precious metals world, and has trailed the performance of other precious metals. While gold and silver are hitting record highs, platinum is not close to its highs of 2008, let alone the inflation adjusted high of 1980, or the much higher inflation adjusted high it made back in the early part of the 20th century.

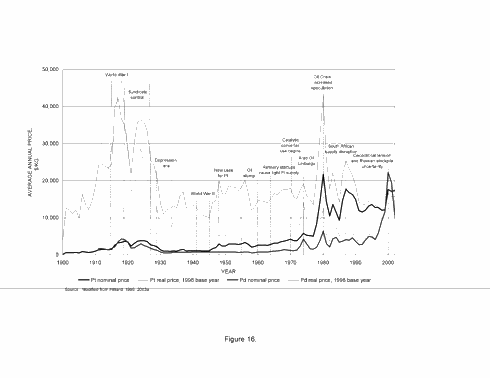

As you can see in the 100 year chart, below [iii], the price of both platinum and palladium was higher, in inflation-adjusted terms, in 1920, than it was at the end of the “Great Stagflation” in 1980. This is not true of gold or silver, which both reached their historical highs in 1980. So, how far can the price of platinum travel? We should remember that rhodium, another metal heavily used in catalytic auto exhaust systems, climbed to as high as $12,000 per troy ounce in 2008. That was before the advent of quantitative easing and during a period in which the debasement of the U.S. dollar was tightly controlled, compared with now.

(Click chart to enlarge)

Frankly speaking, precious metals are one of the few liquid investments worth buying right now. The long term fundamentals underlying platinum are the strongest of the four main precious metals. The "market view" seciton of the 2010 Anglo-American Platinum (AAUKF.PK) annual report tells us that platinum demand in Europe, Japan, North America, China, and the rest of the world (including Brazil, Russia, Korea, etc.) rose by 36% (to 1.4 million ounces), 31% (to 500,000 ounces), 30% (to 470,000 ounces), 50% (to 260,000 ounces), and 21% (447,000 ounces), respectively. During 2010, admittedly, there were a number of incentives for car purchases being given by various governments. However, the price of oil will continue to rise in the long run, and a higher percentage of cars, outside of Europe, are going to be built with inherently more fuel efficient diesel fueled engines, as opposed to gasoline. Platinum is the primary catalyst for diesel and it cannot be replaced by palladium. So, long term, the future demand increase is going to be much bigger than 2010, regardless of incentives or the lack thereof.

Anglo-American is also one of the biggest palladium miners in the world. It says that the demand for platinum's sister metal, palladium, also rose substantially. However, it rose more slowly in almost every market. This difference seems to fly in the face of common sense, given palladium's spectacular price performance in 2010, until we recognize that rapidly increasing palladium prices have more to do with constricted supplies than increases in demand.

An unusual condition currently exists in the palladium market, as a result of a strategic decisions by Russia to reduce the amount of palladium being sold from state stockpiles. This does NOT mean that the stockpiles are empty. We have carefully calculated the production and sale of palladium, over the last 100 years, and are certain that the Russian state palladium stockpile currently totals, at minimum,15-20 million troy ounces. With greatly increased gasoline engine production in China, Russia, and in the rest of the developing world, the stockpile will eventually wind down, but it will take at least 10 years and, maybe, up to 20, for that to fully happen. In the meantime, strong increases in demand are a more stable source of increasing prices. That is why we favor platinum over palladium.

If the Fed continues QE, stocks will rise in nominal terms, but QE will spur more producer price inflation in a time when it is difficult to pass costs on to consumers. This will lead to very bad earnings reports, and the stock market will fall in real terms. Yet, with or without a new round of counterfeiting, all precious metals prices will inevitably rise. In fact, the more stocks fall, the higher metals prices will rise, because investment will be shifted into precious metals and the supply is extremely limited. Should the Fed eventually choose more counterfeiting, as is likely with incompetents like Ben Bernanke and Janet Yellen in charge, all precious metals prices will rise. Platinum will rise higher because the fundamentals are stronger.

We could spend a lot of time speculating on the reasons behind the platinum purchases by JPM. Is it to offset elevated levels of demand by customers, who want to convert unallocated to allocated storage in London? Maybe, and we hope so, but, if it that were the case, it would be centering physical platinum buying in London, rather than in New York. Also, platinum futures prices would already be in backwardation, like silver prices. But, perhaps, the bank is expecting the situation in platinum to evolve into the same type of crisis, and wants to be ready when heavy physical demand begins, That being said, we believe the most likely reason for JPM's platinum buying spree is simply that its analysts have decided platinum is an excellent long term investment. They probably want to get in the door now, before price pressure on the physical commodity rise too far.

As noted in the previous article, positions in platinum can be taken using several different investment vehicles. First, you can buy platinum coins and small bars at a local shop. Second, you can buy shares of the platinum trust ETF (PPLT). Third, you can purchase futures positions at NYMEX. Buying on the futures market is often the cheapest and most efficient method of obtaining large quantities of precious metals[iv]. Finally, you can also buy shares of stocks in platinum miners such as Impala Platinum (IMPUF.PK), Aquarius Platinum (S. Africa), Anglo-American (AAUKF.PK), The problem with the mining stocks, as opposed to bullion, is that the miners are susceptible to errors by management, including excessive compensation, but, also errors such as building mines in countries like Zimbabwe, causing the loss of shareholder capital.

If you choose to accumulate platinum at the futures markets, you may might want to do the same as JPMorgan. The bank, it appears, is very bullish on platinum and is now accumulating the physical metal by taking delivery from the exchange. If you've got enough money, keeping in mind that each contract requires the purchase of a minimum of 50 troy ounces of one of the most precious of precious metals, you should do the same.

It should be remembered that this article emphasizes fundamentals rather than technical analysis. These markets, especially the precious metals markets, are beset by corruption and manipulation. They are also burdened with an alleged regulator, known as the CFTC, which has been awarded exclusive jurisdiction to enforce the commodities laws, and chooses not to do its job, except if that involves attacking a small inconsequential player. We are talking about the long term, which is less subject to corrupt activities. Short term platinum prices could go up or down, all depending on the capricious decisions of a small handful of executives at various banks and hedge funds.

[i] Stopping means taking delivery in the parlance of the futures markets.

[ii] It is worth noting that, in addition to JPM, As of April 2011, another big international financial organization, Deutshe Bank, has also started to buy up physical platinum. According to NYMEX statistics, in January 2011, it was a seller, delivering 132 contracts worth about $11.7 million. But, by April 8, 2011, the German bank was a buyer, having taken delivery of 194 platinum contracts, or a total of 9,700 troy ounces, worth about $17 million. As always, the statistics do not make it clear whether the bank is buying for its own account or that of a customer.

[ii] It is worth noting that, in addition to JPM, As of April 2011, another big international financial organization, Deutshe Bank, has also started to buy up physical platinum. According to NYMEX statistics, in January 2011, it was a seller, delivering 132 contracts worth about $11.7 million. But, by April 8, 2011, the German bank was a buyer, having taken delivery of 194 platinum contracts, or a total of 9,700 troy ounces, worth about $17 million. As always, the statistics do not make it clear whether the bank is buying for its own account or that of a customer.

[iii] Which we have "borrowed" from the U.S. Geological Service.

[iv] Check your broker’s fees before choosing who to deal with, because some futures brokers are now attempting to charge much higher fees, given how popular delivery from the futures market is becoming.

Disclosure: Long platinum.