From Doctor Housing Bubble

The Federal Housing Administration (FHA) has stepped into the housing market in a too big to fail way. Their involvement in the mortgage market is not necessarily a good thing in the long-term. The reason for the FHA popularity is the incredibly low down payment requirement of 3.5 percent. Couple this with the Federal Reserve subsidizing lower mortgage rates and you have a recipe for a nation simply pushing debt off to the future. The FHA is now a mess since it is picking up the slack of defunct toxic mortgage lenders. In 2008 HUD went to Congress for a $143,000,000 subsidy, the first in three decades. More troubling is the projected losses that could amount to $100 billion over time.

The rising delinquency rates and the market share of FHA insured loans assure us problems ahead. Let us look at the proliferation of this product since the housing market bubble burst in 2007.

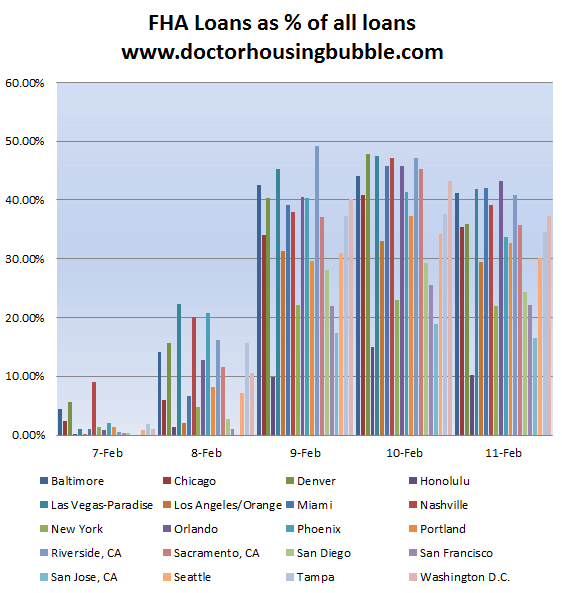

FHA market share of homes purchased with loans

Source: DataQuick

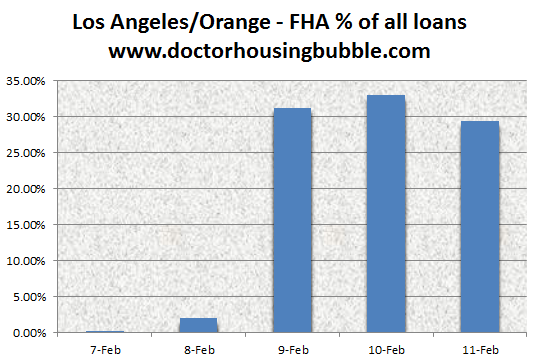

This is a disturbing chart for a variety of reasons. First, FHA insured loans were never meant to be a large part of the market. They were intended to help lower income Americans purchase homes yet many of the larger and more expensive markets are using FHA insured loans as their primary purchase loan product. For example, in 2007 FHA loans were 0.20 of all loans in the Los Angeles and Orange County markets. Today they represent nearly 30 percent of all loans. This is how the growth for the LA/OC area looks like:

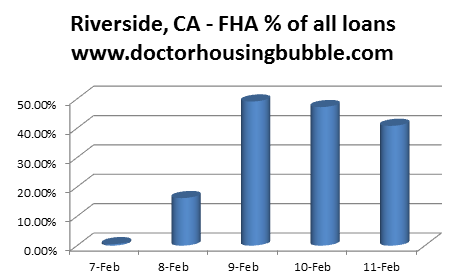

Even more problematic is the dominance of this loan in places like the Inland Empire:

Currently 41 percent of all sales with loans originate with FHA insured loans in Riverside County, an area of California with a notoriously high unemployment rate. Keep in mind these markets have 25 to 35 percent of purchases coming from all cash investors! In other words you are putting people into homes that can barely muster a 3.5 percent down payment and selling homes to investors who want to flip or rent the places out. The normal market buyers of those selling their home to move are virtually a footnote since the bubble burst in 2007. This market dynamic shows no signs of stopping especially given the current shadow inventory. I found it fascinating that the median price for a FHA insured loan is slightly higher than the price paid by all cash investors. It seems like a large pipeline has developed for investors to purchase homes and sell them to first time buyers via FHA insured loans.

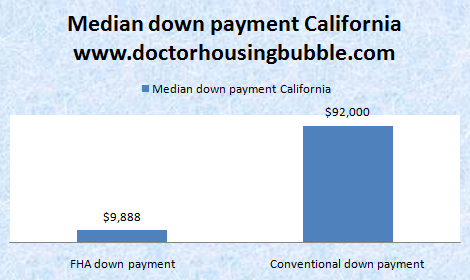

Almost no down payment loans

I was having a conversation with a few colleagues and their perceptions simply do not coincide with the data. They believe that most buyers with mortgages are putting substantial down payments into their purchases. That is not the case especially for non-cash investors. In fact, the majority of FHA insured buyers are doing the absolute minimum:

This amount coincides with the actual median price of a California home ($244,000). So basically people are putting 3.5 percent down on most of these purchases. These loans have now taken up the slack that was lost form the toxic mortgages of the bubble years.

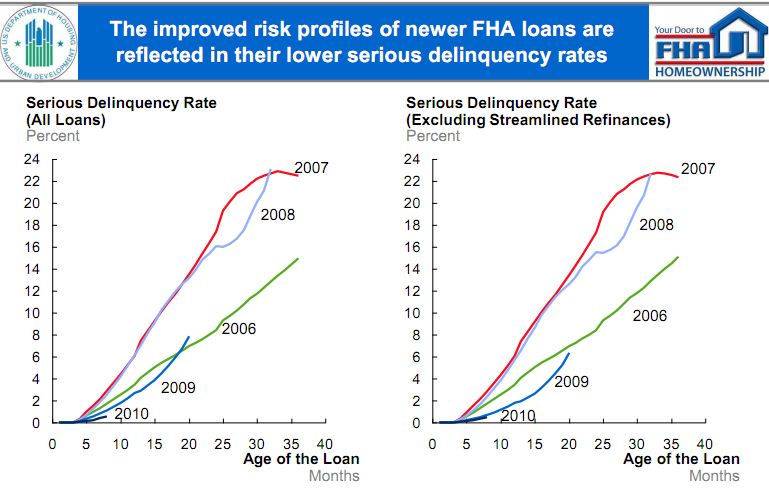

HUD gave a presentation to Congress regarding FHA loans late last year. The report is comical in nature. First, they try to show how FHA insured loans are performing better with newer loans:

Source: HUD

Note how 2008-vintage FHA loans are suddenly deteriorating at an accelerating rate. This was the last year FHA allowed the illegal no-money-down SFDPA loans. Coincidence?

In this presentation they actually prove the opposite! Loans originated in 2007 and 2008 actually are performing worse than those originated in 2006 before the FHA started aggressively entering the market. Next, look at the loans in 2009 and how badly they are now starting to perform. This is not good. Are they trying to use the limited data in 2010 as things begin strong only after 6 months of data? Heck, most option ARMs were performing fantastic if we only looked at one year of data. Wait until mid-2012 and you’ll see these loans crapping out as well. Why? These geniuses in their same presentation have projections for the housing market that already four months into 2011 have failed to materialize:

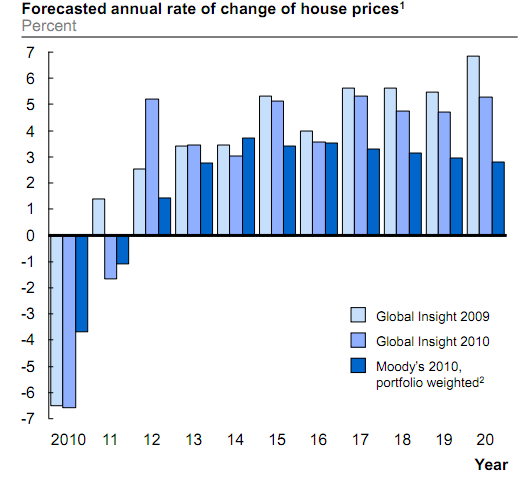

Source: HUD

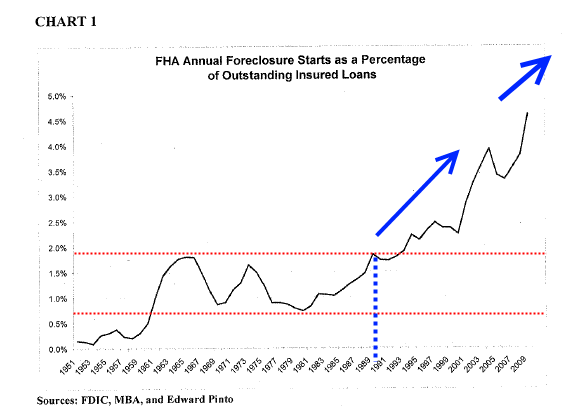

Non-stop perma growth once we are out of 2011 and home prices going up every single year into infinity. By the way, where is the chart for income growth? That might help especially since people pay their mortgage with a W-2 job. One thing we have learned about housing prices is that they do not simply go up. The housing bubble fiasco has taught us that and also Wall Street investment banks have done nothing to reform so the same system that led us to this mess is largely in place. FHA insured loans are the new toxic mortgage but with a touch of down payment spice. Only enough to claim they are not nothing down like adding salt to a soup. Until the down payment requirement is pushed to a minimum of 10 percent we will see problems cropping up:

Many in the mortgage industry love these loans since it allows them to squeeze people into homes they cannot afford. If you can’t save 10 percent for a down payment you shouldn’t buy a home. I would argue it should be 20 percent but the fact that we are still pumping out 3.5 percent down loans is maddening. Plenty of nice rental homes so this isn’t like a choice between living under the riverbed and owning a palace. Those in the housing industry argue this is good for homeownership and to that I say then you fund the loans. If you are so up on these loans you use your own money and not government backed subsidized programs that blast off economic rents to the toxic financial industry while the costs will hit the taxpayer years down the road. Enough of this toxic financial industry.

These kind of loans also force home prices to stay inflated above real market levels. If people were required to save for a down payment home prices would need to adjust lower to reflect what people can afford. Plus it shows a discipline to save and restraint in not buying every new iPhone that pops out or every new plasma TV that hits the market. In California in 1997 the median price was in the high $100k range because that was all people could afford with their incomes. Incomes have not changed over that time to reflect current home prices. The only reason prices remain at current levels is because of maximum leverage loans. FHA insured loans are the new stop-gap measure. Expect future losses here. What do banks care since this is all explicitly backed by the government (aka you)? If banks had faith in the borrowing public they would put their money out in mortgages and hold onto them. Of course they rather borrow your money and speculate in global stock markets since the return is higher.