We hope you have plenty of physical silver put away, because when these two markets hit their trough and apex simultaneously, there will be unimaginable real estate bargains for those holding physical silver.

From Doctor Housing Bubble

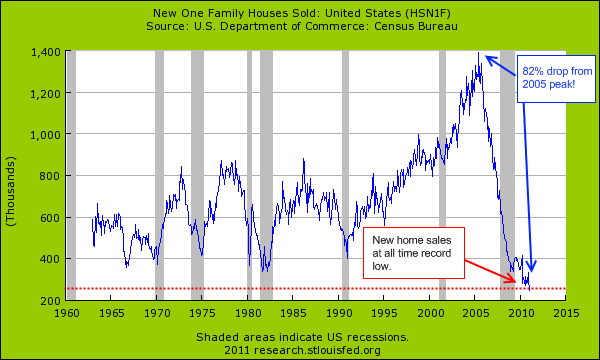

This is now officially the worst housing crash since the Great Depression. Putting aside hyperbole new home sales fell 80 percent from 1929 to 1932. Those years, if you know a bit of history were not model years for the U.S. economy. In fact, the economy imploded in spectacular fashion at that time thanks to time honored Wall Street speculation and massive debt leverage. So a fall of new home sales by 80 percent during those years would be expected. Over this duration the Dow Jones Industrial Average fell 89 percent. Now compare this to our current situation. New home sales from their 2005 peak have now fallen by 82 percent! However the Dow Jones is only off by 13 percent from the peak reached in 2007. The big difference in this crisis is that we had a Federal Reserve that bailed out big banking interests under the pretense of saving the housing and consumer market. Yet how can you save a housing market that by definition is too expensive for the immediate population? Going on four years of this crisis I’m sure many now understand the finer points of crony capitalism. Hope Now, HAMP, foreclosure moratoriums, and other methods of saving the housing market were largely cover for a bigger bailout scheme and most of you were not included.

The record collapse in new home sales

Notice how the shaded area above ends in June of 2009? We’ve been out of a recession for nearly two years folks! Of course that did not stop us from reaching a new trough in new home sales. New home sales have fallen by 82 percent which trumps the drop of 80 percent from 1929 to 1932. This collapse has come with a fury unrivaled in our historical data. New home sales show the health of the “housing industry” because these are properties that are freshly built and employ hundreds of thousands of workers. This is one industry that for reasons of location, cannot be outsourced. So reaching this new low tells us a few things about our economy.

What we can learn from the low in new home sales is that the market is dominated by distressed home sales. People are hungry for low priced homes and these tend to be foreclosure sales. Given the years of inflated home prices and exotic mortgages we now have a healthy pipeline of troubled properties floating out in the market. Why would anyone want to buy a new and more expensive home when you can pick up a relatively new foreclosure for a much lower price? The above chart is merely reflecting the changes in household wealth and investor demand.

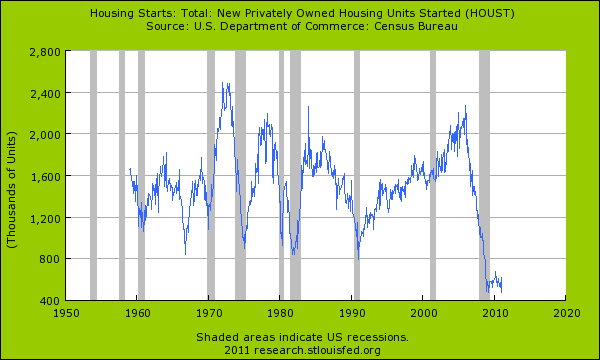

U.S. housing starts show no market turn around

If you want to see the nucleus of a housing turn around you can look at U.S. housing starts. This is the first place that will show any turn around. This too is at a record low. In other words the market is plastered with distressed homes and there is little need for new housing. Many housing analysts point to new demand but fail to account for the contraction in household formation and the fact that many younger families are now entering a workforce with much lower wages (plus we have a surplus of vacant homes). Sure, there is demand for housing but this can be for rentals or for people consolidating households (aka living with parents, friends, etc). Now why would people do this? Because as it turns out the employment situation is still unhealthy:

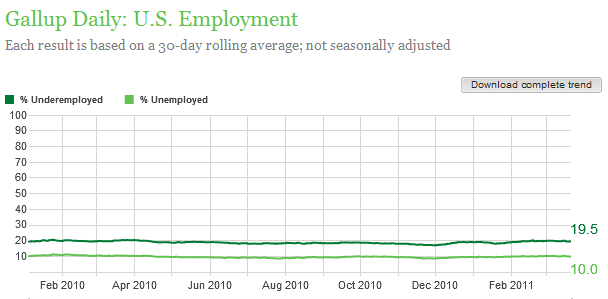

Source: Gallup

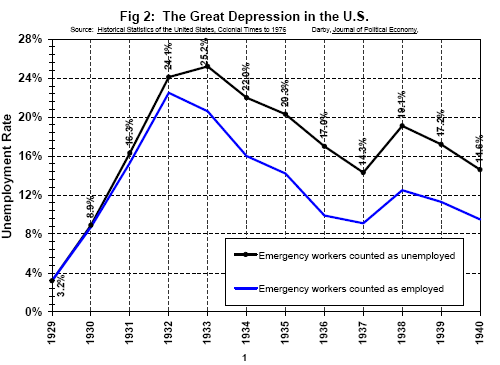

According to Gallup’s daily tracking data the current underemployment rate is 19.5 percent. Working 10 hours a week for a few dollars is not exactly spurring a new segment of demand for high priced McMansions. Even if a person can squeeze into a McMansion can they afford the insanely high cooling and heating bill? An investor in Nevada who bought last summer was surprised his electric bill came in at $300 for the summer. It is hard to increase housing costs when wages are stagnant. I found an older chart of unemployment during the Great Depression:

Depending on how you measure it, if the headline underemployment rate is 17 or 19 percent depending on the data source we are between 1935 and 1936. Keep in mind our giant part-time underemployed sector of our economy. Since the Great Depression the safety net has gotten stronger so that is a big reason why we don’t see anything close to what happened back then. Yet many are a few hundred dollars away from this. 1 out of 6 Americans are on some kind of food assistance and 50 million are receiving Social Security. These are programs that got their start because of the Great Depression. Times are tough and the bailouts have propped up investment banks creating global speculation and a domestic increase in GDP. So by official standards we have been out of a recession since June of 2009 but not in what many think of as a healthy economy. Unemployment is still sky high, the housing market is still crashing, and wages are falling or stagnant. Yet we call this a recovery because trillions of dollars were pumped into the stock market?

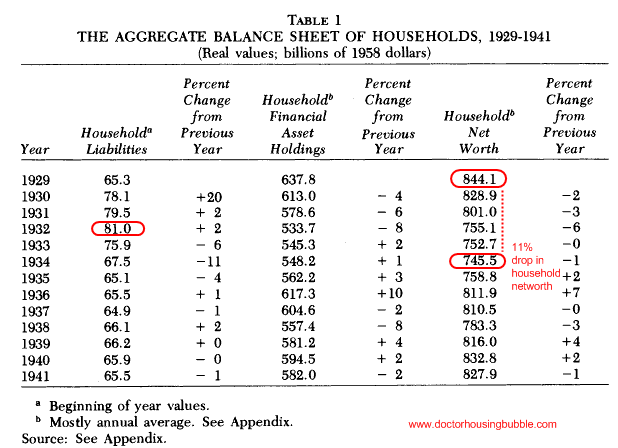

The real wealth of households

This is an interesting chart. Real household wealth fell by 11 percent during the Great Depression. As of December of 2010 U.S. household net worth is down 13 percent ($8.8 trillion) from the peak reached in 2007. Just trying to put this fantastic recovery in context here.

Part of the challenge moving forward is fixing a system that inherently rewards bad behavior. I was reading a recent article where Bernard Madoff called the U.S. economy one giant Ponzi scheme. The sad fact is he is right. There is no Social Security Trust Fund or “lock box.” It is just a giant accounting gimmick to suck away current payroll taxes for other programs. Money comes in and it goes out to all sorts of government items including giant banking bailouts. This is a cornerstone of a Ponzi scheme right? Those who got in early do fantastic but those at the end well, they usually end up footing the bill or watch the system collapse. Just think of the reward system here:

-Big banks create an environment to speculate on mortgages. Glass-Steagall is repealed so commercial and investment banking now mix. Your local teller who is now a personal loan assistant sells you an option ARM. This option ARM goes to a Wall Street investment banks that sell it off to some fund in Iceland that thinks it is buying a triple-A rated bond. Everyone gets paid along the way during the bubble but look at who pays when it unravels.

-Home buyer: most will lose their home to foreclosure if they bought near the peak. In expensive gimmick states like California you have mark-to-market suspension nonsense and banks have been trying to delay for nearly four years now. Prices are not coming back. As we have shown we are now seeing much higher priced foreclosures in mid-tier markets. *Reward: get to live in a home you cannot afford for a set time period.

-Commercial banks: the too big to fail have gotten bigger. In fact, for their ability to sell junk loans many of the big banks were given access to even bigger toxic loan producers like Countrywide Financial and WaMu. The reward for pumping toxic loans is that you get to grow even bigger with government support. *Reward: taxpayer subsidies to grow even bigger and swallow up crappy institutions. Incredibly expensive and pervasive system.

-Wall Street investment banks: probably the biggest winners here. The few politically connected enough to survive on their own were able to eat more of the pie with many of their friends now in the belly of commercial banks (there is really no distinction anymore). Bonus pool goes hog wild since competitors are now out and you are fortified by the Federal Reserve. It pays to have a U.S. Treasury chief as a former CEO. *Reward: giant bonuses for blowing up the world economy.

-Investors that bought these mortgages: If you are not a Wall Street investment bank and are a poor soul like Iceland, you get to pay the bill. As we know there is no free lunch. Ultimately someone in the food chain has to pay. In the end it is investors without the connections for bailout money and prudent domestic taxpayers. It certainly isn’t the home buyer who over leveraged buying a home they cannot afford. Commercial banks? Bwahahahaha! Chase seems to open up a new branch every week on a different corner in Southern California. And all you need to do is look at the bonus pool at investment banks and you realize there is little pain for their destructive financial ways.

Yet the pain is in the housing market still. New home sales have collapsed to levels even below those of the Great Depression. Then again we’ve been in a recovery since the summer of 2009 so why let these 2011 stats get in the way of that.