From Goldcore:

Gold’s London AM fix this morning was USD 1,651.00, EUR 1,246.04, and GBP 1,040.85 per ounce. Yesterday's AM fix was USD 1,636.00, EUR 1,243.16 and GBP 1,035.97 per ounce.

Silver is trading at $31.65/oz, €23.92/oz and £19.99/oz.Platinum is trading at $1,617.00/oz, palladium at $649./oz and rhodium at $1,425/oz.

Gold fell 0.41% or $6.80 in New York yesterday and closed at $1,642.50/oz. Gold traded sideways in Asia overnight and rose in European trading which has gold now trading at $1,650.89/oz.

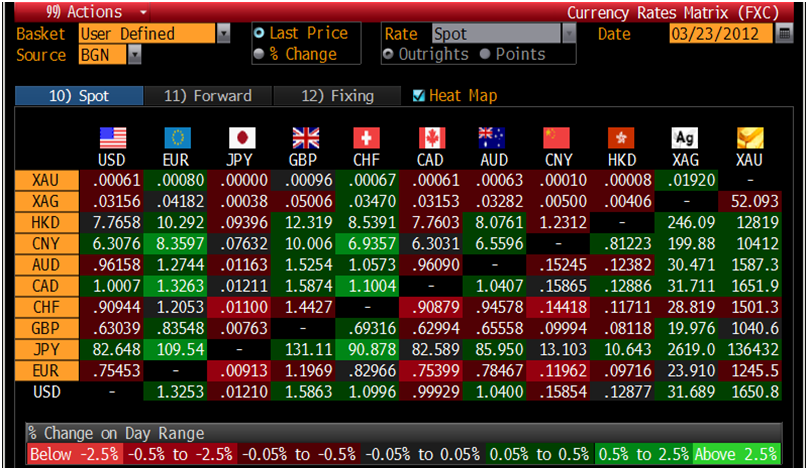

Cross Currency Table – (Bloomberg)

Hopes that the US economy is recovering and that the Eurozone debt debacle is over has led to increased risk appetite in recent weeks. This sent gold to a 2 month low yesterday.

Gold has fallen 2.8% so far in March. This has been attributed to Fed Chairman Bernanke denying that QE will take place.

Investors will be watching the fund flows to see if large institutions and hedge funds are increasing or reducing allocations to gold ETF’s which could influence prices.

ETF gold demand has remained strong and “sticky” showing that most buyers are long term and passive in nature and not speculators, traders or paper players who use the COMEX and futures markets to get exposure to gold.

Technicals: Euro Gold Testing Support at 200 DMA - EUR 1,239/oz

Gold’s technicals remain poor and prices are heading for their fourth straight week of losses. This is particularly the case in US dollar terms due to the recent period of dollar strength.

XAU-EUR 1 Year Chart – (Bloomberg)

However gold’s technicals in euro and other fiat currency terms are not as poor. Euro gold support is at the 200 daily moving average (DMA) at EUR 1,239.35/oz. As can be seen in the charts buying euro gold at the 200 DMA has been prudent in recent years. For those wishing to time the market this is another good buying opportunity.

Gold continues to climb the classic bull market ‘wall of worry’ and this has all the hallmarks of yet another period of correction and consolidation prior to further depreciation in the euro and other fiat currencies.

From a contrarian point of view, as long as the words ‘fiat’ and ‘debasement’ remain taboo in the popular press and media, gold’s bull market seems assured.

Gold +15% To $1,850/oz in Q2 On Inflation and Currency Debasement - BARCAP

Barclays Capital see this most recent sell off as an opportunity to buy gold.

With gold prices are at their lowest since January, Barclays Capital are buying the dip as they expect gold to rally around 15% to $1,850/oz by the second quarter due to currency debasement and inflation worries.

XAU-EUR 5 Year – (Bloomberg)

BarCap said it expects precious metals to be one of the commodity price leaders in the second quarter, citing the "resumption of the kind of currency debasement/inflation concerns that have been the big driver of gold and silver prices over the past 12 months".

It recommended that investors take a long position in December 2012 palladium, saying lower Russian exports should push the market into a supply deficit and bring prices "significantly above current levels" by later this year.

BarCap put a second-quarter price of $745 per ounce for palladium futures on the London Metal Exchange, versus the past four weeks' average of $701. Spot palladium on the LME hit a session bottom below $645 on Thursday.

OTHER NEWS

(Bloomberg) -- India Sets Benchmark Import Price of Gold at $530 Per 10 Grams

India set the benchmark price for imports of gold at $530 per 10 grams, according to an e-mailed statement from the finance ministry.

The benchmark price for imports of silver was set at $1,036 a kilogram, it said.

(PTI) -- Govt slashes import tariff value of gold to $530/10 grams

The government today reduced the import tariff value of gold from USD 573 per 10 grams to USD 530 per 10 grams, while the value was kept unchanged at USD 1,036 per kg for silver imports.

The tariff value, which is released fortnightly, is the base price on which the customs duty is determined to prevent under-invoicing and discourage import of gold to ease pressure on balance of payments.

The Central Board of Excise and Customs (CBEC) issued a notification yesterday in this regard, an official release said. After crude oil, gold is the most imported commodity in India in terms of value.

Bullion traders and jewellers have opposed the recent hikes in tariff value as it would hit demand as the increased costs have to be passed on to consumers.

Early this year, the government had changed the duty structure on gold and silver from specific to value-linked, making precious metals more expensive.

The import duty on gold was fixed at 2 per cent of the value, instead of the earlier rate of Rs 300 per 10 grams. On silver, the import duty was pegged at 6 per cent, as against Rs 1,500 per kg earlier.

India, the world's biggest consumer of gold, imported 967 tonnes of gold in 2011.

(Bloomberg) -- Swiss Palladium Imports in February Were 1,097 Kilograms

Swiss imports of palladium were 1,097 kilograms in February, the Swiss Federal Customs Administration said today in an e-mailed report.

(Bloomberg) -- Swiss Platinum Imports Were 2,639 Kilograms in February

Swiss platinum imports were 2,639 kilograms in February, the Swiss Federal Customs Administration said in an e-mailed report today.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWS

(Reuters)

Gold off 2-mth low but heads for 4th week of losses

(CNN)

Gold Loses Luster in Face of US Recovery

(Wall Street Journal)

Indian Gold: Its Worth and Its Wait

(Wall Street Journal)

Gold Smuggling Redux in India?

(The Financial Times)

China and Australia in $31bn currency swap

(Reuters)

BarCap banks on gold as prices hit 2-month lows

(The Telegraph)

Hoard of 30,000 silver Roman coins discovered in Bath

COMMENTARY

(Forbes)

Bernanke Decries Gold, Defends Fed's Make-It-Up System

(Federal Reserve Bank of Dallas)

Why We Must End Too Big to Fail—Now

(Resource Clips)

Gold Auguries—Fire Fighting

(Free Gold Money Report)

Turk Dismantles Bernanke's Misleading Gold Standard Lecture

(End of the American Dream)

10 Signs That America Is On The Verge Of A Horrible Municipal Debt Crisis

(King World News)

There Will Be a Sudden Catastrophic Shift as Control is Lost

(Zero Hedge)

Gold Outperforms As Stocks Drop and Volume Pops