UK unemployment soared to 2.62 million in Q3 and joblessness among young people climbed above 1 million for the first time since at least 1992. Sterling fell against all majors and gold due to the appalling jobs numbers and more indications that the BoE will embark on QE3 – further devaluing sterling.

Gold in British pounds has risen to £1,125/oz and is now only 5% below the record nominal high reached on the 5th of September of £1,179/oz.

From Goldcore:

Gold is trading at USD 1,775.20, EUR 1,318.30, GBP 1,125.30, CHF 1,630.20 , JPY 136,576 and CNY 11,263 per ounce.

Gold’s London AM fix this morning was USD 1,773.00, GBP 1,124.43, and EUR 1,311.49 per ounce.

Yesterday's AM fix was USD 1,765.00, GBP 1,113.99, and EUR 1,302.39 per ounce.

Euro/Gold Outperforms Stoxx 600, German Bunds and Euro Assets (Reuters Chart)

Gold is marginally lower today but is consolidating in all currencies after French, Belgian and Austrian bond yields gained sharply yesterday as contagion takes hold in the Eurozone. French financial markets experienced turmoil on Tuesday, reflecting fears that France is being sucked into the spiraling debt crisis.

UK unemployment soared to 2.62 million in Q3 and joblessness among young people climbed above 1 million for the first time since at least 1992. Sterling fell against all majors and gold due to the appalling jobs numbers and more indications that the BoE will embark on QE3 – further devaluing sterling.

Gold in British pounds has risen to £1,125/oz and is now only 5% below the record nominal high reached on the 5th of September of £1,179/oz.

COMEX gold options floor trader Jonathan Jossen told Reuters that there were lots of bullish plays on gold yesterday. Out-of-the money bull call spreads and outright out-of-money calls were seen with $1,800, 1,900, 2,000 and 2,100 being popular strike prices.

US regulator, Bart Chilton, the Democratic commissioner at the US Commodity Futures Trading Commission said he thinks “something nefarious” occurred at MF Global, deepening the criticism facing the fallen futures brokerage.

As customers worried about whether they will recoup the full value of their accounts, some filed court papers on Tuesday looking to form a committee to protect their interests.

Chilton told Reuters Insider that US regulators are closer to finding out what happened to roughly $600 million in missing customer money.

“The money is not where it should be. I think something nefarious has happened, potentially something illegal,” he said.

Reuters also reports how CFTC Commissioner Bart Chilton, who recently acknowledged silver market manipulation, said the regulator's budget should not be cut.

One of the more high profile victims of MF Global’s fraud is economist and trends forecaster Gerard Celente.

Celente became the latest victim of the MF Global bankruptcy when funds, in the six figures, in his gold futures account were taken (or ‘looted’ as Celente called it) by Chapter 11 trustees. Celente was hit with a margin call within days of the corporate shutdown despite his account being fully funded.

(YouTube) – Gerald Celente on His Gold Account Being ‘Looted’ by MF Global

Celente told Russia Today (RT), “I really got burned, I got a call last Monday, I have an account with Lind-Waldock, and I have been trading gold since 1978, and I have a very simple strategy. As you well know, I’ve been very bullish on gold for many years… So I was building up my account to take delivery on a contract, and I got a call on Monday, and they said I needed to have a margin call. And I said, what are you talking about, I’ve got a ton of money in my account. They responded, oh no you don’t, that money’s with a trustee now.”

He said that MF Global “have cleaned out and ruined a lot of people. So maybe the name MF, I’m thinking the first word of MF is ‘mother’ and we could put the other word in there if you use your imagination . . . because that is what they are doing to everybody.”

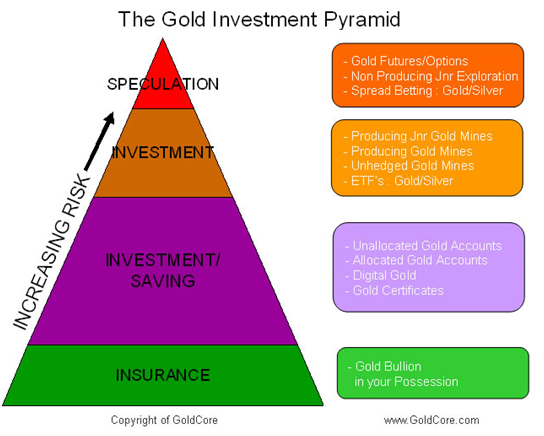

Celente is astute and is on record regarding the importance of owning physical gold bullion. The incident shows the increasingly fundamental importance of owning physical bullion (see table above) – either by taking delivery or by owning in personal allocated accounts.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $34.47/oz, €25.55/oz and £21.83/oz

PLATINUM

Platinum is trading at $1,629.20/oz, palladium at $655.50/oz and rhodium at $1,600/oz.

NEWS

(Reuters)

Gold tracks euro down on contagion fear

(Wall Street Journal)

Gold Ekes Out Increase As Dollar Pares Gain

(The Telegraph)

The Banknotes That Could Return If The Euro Collapses

COMMENTARY

(MarketWatch)

Gold is the Only Winner from the Euro Crisis

(Financial Post)

Could Europe’s gold solve the debt crisis?

(DJ Financial News)

The Demise of Monetary Unions Past: Austro-Hungary

(Gold Standard Institute)

Gold Standard Institute's November Newsletter

(Forbes)

Is Gold Headed For $3,000?

(YouTube)

Gerald Celente on His Gold Account Being ‘Looted’ by MF Global