COT data in the US shows that speculative sentiment has fallen dramatically which is bullish from a contrarian perspective. The Got Gold Report reports that silver futures market data is the most bullish it has been since 2003 - eight years ago. Silver was priced at about $4.40 per ounce then. Large commercial shorts have dramatically reduced their positions after the selloff in recent weeks suggesting that we are likely at or very close to silver bottoming. While the figures for gold are not as dramatic they too show that speculative positions and sentiment has been reduced significantly. Venezuela will repatriate some gold reserves held abroad before December 24th, Central Bank President Nelson Merentes told reporters today in Caracas according to Bloomberg. “I can’t give you an exact date for security reasons,” Merentes said. Venezuela will keep an unspecified portion of its gold reserves in foreign institutions, he said. In August, President Hugo Chavez ordered the central bank to repatriate $11 billion of gold reserves as a safeguard against volatility in financial markets. Venezuela held 211 tons of its 365 tons of gold reserves in US, European, Canadian and Swiss banks as of August.

COT data in the US shows that speculative sentiment has fallen dramatically which is bullish from a contrarian perspective. The Got Gold Report reports that silver futures market data is the most bullish it has been since 2003 - eight years ago. Silver was priced at about $4.40 per ounce then. Large commercial shorts have dramatically reduced their positions after the selloff in recent weeks suggesting that we are likely at or very close to silver bottoming. While the figures for gold are not as dramatic they too show that speculative positions and sentiment has been reduced significantly. Venezuela will repatriate some gold reserves held abroad before December 24th, Central Bank President Nelson Merentes told reporters today in Caracas according to Bloomberg. “I can’t give you an exact date for security reasons,” Merentes said. Venezuela will keep an unspecified portion of its gold reserves in foreign institutions, he said. In August, President Hugo Chavez ordered the central bank to repatriate $11 billion of gold reserves as a safeguard against volatility in financial markets. Venezuela held 211 tons of its 365 tons of gold reserves in US, European, Canadian and Swiss banks as of August.From Goldcore:

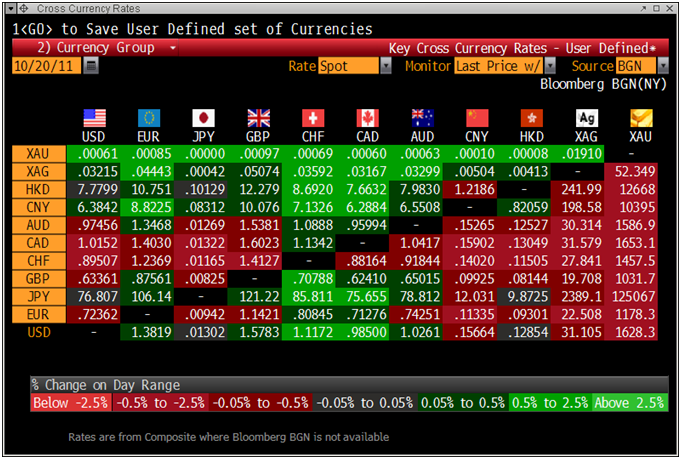

Gold is trading at USD 1,629.65, EUR 1,179.88, GBP 1,032.54, JPY 125,131.05, AUD 1,587.21, CHF 1,456.78 and CNY 10,564.

Gold’s London AM fix this morning was USD 1,629.00, GBP 1,033.24 and EUR 1,180.17 per ounce.

Yesterday’s AM fix was USD 1,651, GBP 1,045.14 and EUR 1,192.74 per ounce.

More institutional money likely to move into precious metals on outperformance

Gold has fallen marginally again in all major currencies. Concerns about the increasingly intractable nature of the Eurozone debt crisis and rumours of a Franco-German split regarding a solution, prior to the emergency debt summit this weekend, is leading to risk aversion in markets.

This is not helped by further concerns about the US economy after the Beige Book highlighted how close the US economy is to a double dip recession.

Further short term weakness in the gold market is possible and there appears to be a need for further consolidation.

However, global physical demand is very strong at these levels. Premiums in Asia have eased somewhat but remain healthy.

Premiums on gold bars in Hong Kong and Singapore are at $2.00 and $2.50 respectively. Vietnamese premiums were $27.79 over spot gold of $1,662.20 and Shanghai gold closed at a premium of $10.15 to world gold of $1,652.05.

Cross Currency Table

COT data in the US shows that speculative sentiment has fallen dramatically which is bullish from a contrarian perspective.

The Got Gold Report reports that silver futures market data is the most bullish it has been since 2003 - eight years ago. Silver was priced at about $4.40 per ounce then.

Large commercial shorts have dramatically reduced their positions after the selloff in recent weeks suggesting that we are likely at or very close to silver bottoming.

While the figures for gold are not as dramatic they too show that speculative positions and sentiment has been reduced significantly.

Venezuela will repatriate some gold reserves held abroad before December 24th, Central Bank President Nelson Merentes told reporters today in Caracas according to Bloomberg.

“I can’t give you an exact date for security reasons,” Merentes said. Venezuela will keep an unspecified portion of its gold reserves in foreign institutions, he said.

In August, President Hugo Chavez ordered the central bank to repatriate $11 billion of gold reserves as a safeguard against volatility in financial markets. Venezuela held 211 tons of its 365 tons of gold reserves in US, European, Canadian and Swiss banks as of August.

The ‘Chart of the Day’ above shows how precious metals have outperformed other assets since 2000.

This outperformance is likely to lead to international institutional money being allocated to precious metals. A small degree of this has been seen already but institutions remain massively underweight precious metals with many having no allocations whatsoever and some having meager allocations to gold.

Given concerns about currencies and the risk of contagion and a global systemic crisis, this is very likely to change.

The small size of the gold and especially the silver market means that even a small increase in allocations to precious metals could result in dramatic price moves and large annual price gains as seen in the 1970s.

Gold rose 49.7% in 1972, 73.5% in 1973, 60.1% in 1974 and 140% in 1979.

Similar price moves are quite possible in the coming years given the very small size of the physical market vis-à-vis equity, bond & currency markets today.

Gold has risen by over 500% since 2000. In comparison, gold rose by 2,300% in just 9 years from 1971 to 1980.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $30.80/oz, €22.32/oz and £19.52/oz

PLATINUM GROUP METALS

Platinum is trading at $1,489.50/oz, palladium at $599/oz and rhodium at $1,525/oz.

NEWS

(Reuters)

Gold drops 1 percent as euro zone debt worries mount

(Mineweb)

Gold could test $1500 but then bounce to trade as high as $3400 - CitiFX

(Bloomberg)

Silver Bear Market Seen Ending on Europe Crisis

(Reuters)

Pamela Anderson Champions Palladium as Gold Prices Soar: Retail

COMMENTARY

(Wall Street Journal)

Gold: Here’s Why It Could Get to $2000 Soon

(ZeroHedge)

Ironic "Scariest Chart Ever" Redux - America Will Surpass 100% Debt To GDP On Halloween

(KingWorldNews)

Stephen Leeb - World Money Supply Tied to $10,000 Gold Bow

(GotGoldReport)

Gene Arensberg: Silver COT Most Bullish in Eight Years