The Merkel Sarkozy plans to centralize financial and economic governance in the EU has failed to calm markets and there is further weakness in stock markets today. A key aim of the meeting was to restore confidence in the euro. In the short term this has not been achieved and it is highly unlikely that it will be achieved in the long term. Centralised financial and economic governance will not be a panacea to the current debt crisis. It does nothing to address the root cause of the problem which is massive indebtedness and the saddling of taxpayers with massive liabilities incurred by banks. Concerns about currencies and currency debasement is leading to continued safe haven demand for gold.

The Merkel Sarkozy plans to centralize financial and economic governance in the EU has failed to calm markets and there is further weakness in stock markets today. A key aim of the meeting was to restore confidence in the euro. In the short term this has not been achieved and it is highly unlikely that it will be achieved in the long term. Centralised financial and economic governance will not be a panacea to the current debt crisis. It does nothing to address the root cause of the problem which is massive indebtedness and the saddling of taxpayers with massive liabilities incurred by banks. Concerns about currencies and currency debasement is leading to continued safe haven demand for gold.From Goldcore:

Gold is mixed in various currencies today after French President Nicolas Sarkozy and German Chancellor Angela Merkel unsurprisingly failed to deliver a solution to the euro zone debt crisis.

The London AM fix in USD was a new record nominal high. Gold’s London AM fix this morning was USD 1,792.00, EUR 1,240.39, GBP 1,089.96 per ounce (from yesterday’s USD 1,779.00, EUR 1,236.18, GBP 1,086.81 per ounce see LBMA).

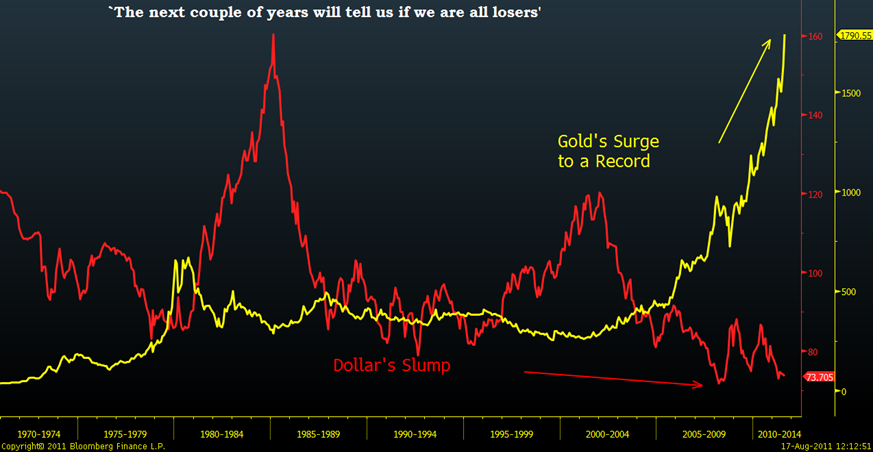

Bloomberg ‘Chart of the Day’

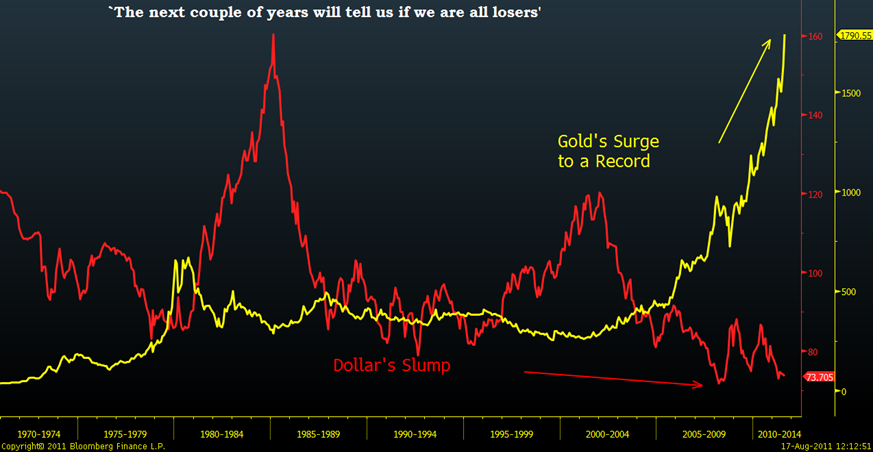

Euro gold is higher again today despite the meeting and at €1,238/oz remains close to record nominal highs of €1,283/oz. Sterling is down 0.45% against gold after the poor UK jobs number. The Swiss franc has surged against all currencies including gold but remains over 1,400 CHF/oz.

Gold in Euros – 30 Day (Tick)

The Merkel Sarkozy plans to centralize financial and economic governance in the EU has failed to calm markets and there is further weakness in stock markets today.

A key aim of the meeting was to restore confidence in the euro. In the short term this has not been achieved and it is highly unlikely that it will be achieved in the long term.

Centralised financial and economic governance will not be a panacea to the current debt crisis. It does nothing to address the root cause of the problem which is massive indebtedness and the saddling of taxpayers with massive liabilities incurred by banks.

Concerns about currencies and currency debasement is leading to continued safe haven demand for gold.

Cross Currency Rates

Demand for coins and bars in Europe remains strong and is increasing. It remains small compared to allocations to other asset classes suggesting that recent increases in demand for physical are sustainable.

Demand for bullion in Asia remains robust as seen in premiums in India, Singapore and Hong Kong. Gold bar premiums in Hong Kong remain steady at 50 cents to $1.00 per ounce above spot gold.

Higher and record nominal prices is not deterring store of value and safe haven buyers internationally. This should support gold and ensure that any correction is again short and shallow.

For the latest news and commentary on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $40.32/oz, €27.84/oz and £24.43/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,841.70/oz, palladium at $771/oz and rhodium at $1,750/oz.

NEWS

(Reuters)

Gold steady, euro zone crisis seen lingering

(Reuters)

Paulson held onto gold in Q2, Soros cuts further

(Bloomberg)

Venezuela May Move Reserves From U.S. to ‘Allied’ Countries, Says Lawmaker

(Financial Times)

Perry compares Fed stimulus to treason

(Financial Times)

Merkel and Sarkozy pledge to defend euro

COMMENTARY

(The Telegraph)

Collapse in German growth will add to euro rebellion

(The Telegraph)

Europe's Fiscal Overkill

(NY Times)

Gordon Brown: Saving the Euro Zone

(Gold Standard Institute)

The Gold Standard Newsletter - August

(Got Gold Report)

Gene Arensberg: Comex commercials, swap dealers put floor under silver

(You Tube)

Jon Stewart on the Media Ignoring Ron Paul