From Doctor Housing Bubble:

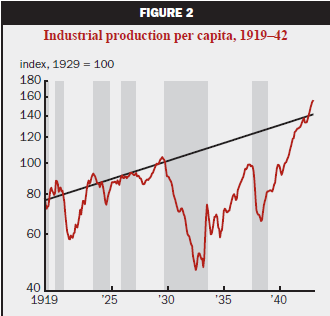

The U.S. economy is facing some serious challenges ahead. Looking at the current economic climate it feels eerily similar to the 1937-38 recession that occurred during the Great Depression. Some think that the Great Depression occurred overnight on a gloomy day in October of 1929 but we had a decade long build up of rampant speculation and bad investments that led up to the crash. The bottom hit in 1932 and 1933 with unemployment soaring to 25 percent. Yet the story never ended on that date. Throughout the Great Depression even with massive government spending the unemployment rate remained above 15 percent for all of the 1930s.

Without a doubt the early success that occurred for the government after 1933 was largely based on government spending. However government spending back then was largely focused on the working class while today most of the stimulus has been shoveled to the financial industry. It is helpful to look at history as a guide since we are facing many similar issues today even though things seem to be stable for the moment.

Persistently high unemployment and growth dependent on government spending

Data for 1910-1930 from Christina Romer (1986), Spurious Volatility in Historical Unemployment Data

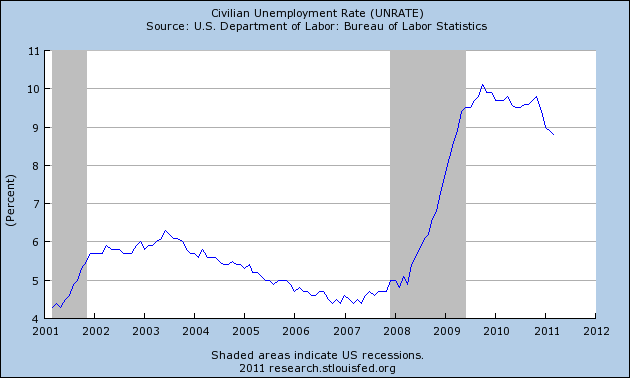

People have unique perspectives regarding the Great Depression and a large part of it stems from deep rooted ideology. The fact is fiscal spending did boost the U.S. economy out of the depths of the recession. This should be obvious. If the government steps in to provide jobs and spends money where the public is not, this will help the bottom line GDP numbers. Yet as the chart above shows the unemployment rate remained stubbornly high for the entire 1930s. The headline unemployment rate has been over 8 percent now going on three years:

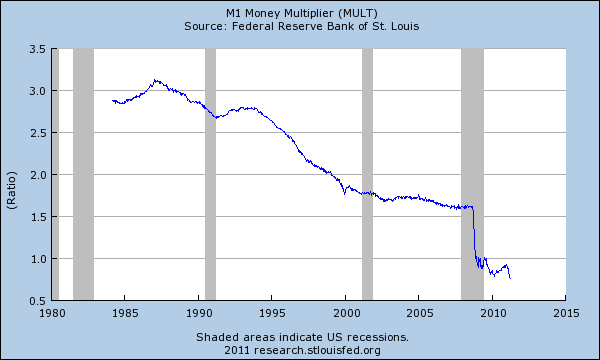

Much of the recent economic stabilization has come from massive government spending. Yet when you inject money like this into an economy you don’t always get the best bang for your buck and that is exactly what we have. In fact, if we actually look at the M1 multiplier you are seeing how ineffective more injections of liquidity have been for the economy:

The ratio is now under 1 which makes any more Fed actions more challenging:

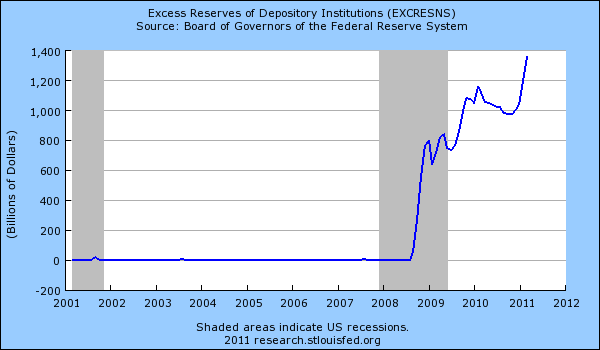

“(Greg Mankiw) Econ prof Bill Seyfried of Rollins College emails me:Nothing has changed in the last two years as the chart highlights. Yet Fed policy remains the same and excess reserves continue to grow:

Here’s an interesting fact that you may not have seen yet. The M1 money multiplier just slipped below 1. So each $1 increase in reserves (monetary base) results in the money supply increasing by $0.95 (OK, so banks have substantially increased their holding of excess reserves while the M1 money supply hasn’t changed by much).”

The Federal Reserve pays interest on this by the way:

“(Federal Reserve) The Federal Reserve Banks pay interest on required reserve balances–balances held at Reserve Banks to satisfy reserve requirements–and on excess balances–balances held in excess of required reserve balances and contractual clearing balances. The Board of Governors has prescribed rules governing the payment of interest by Federal Reserve Banks in Regulation D (Reserve Requirements of Depository Institutions, 12 CFR Part 204).”This also addresses those questions about massive inflation because of the trillions of dollars in liquidity funneled into the banking system. Much of the money is kept in the hands of banks and isn’t flowing into American households. The actual funds banks do have are used to invest in global markets to chase higher profits. In other words they are not investing back in the American people although the Federal Reserve opened up massive liquidity lines for this specific purpose. Yet with Republicans and Democrats both bringing to the table $4 trillion in proposed cuts, the economy will need to stand on its own two feet. Is it ready?

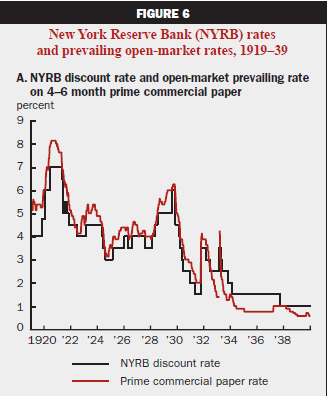

If we look at the Fed funds rate from 1919 to 1939 we realize that rates were also low back then:

Source: Cleveland Fed

There have been arguments about the Fed ushering in the 1937 to 1938 recession but it certainly wasn’t because of the Fed funds rate which was incredibly low just like it is today. Economists during 1937 largely attribute economic growth because of government spending. Yet fears of an unbalanced budget lead to cuts in spending and guess what happens? The nation falls into another recession in the midst of the Great Depression:

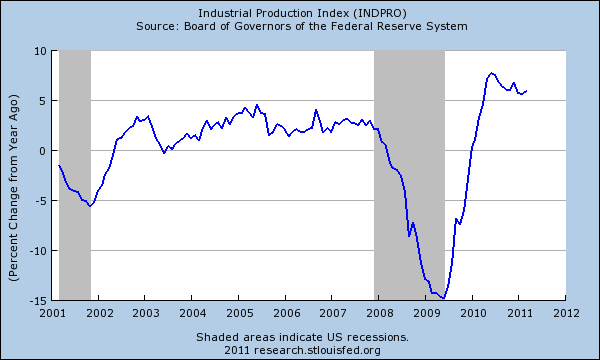

If we look at year-over-year changes in our current industrial production we see that the rate is slowing down significantly:

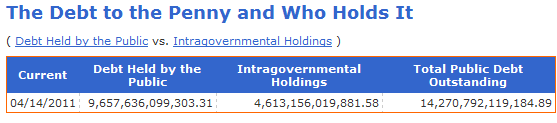

It is clear that we zoomed up from the bottom but how much of this was due to massive trillion dollar bailouts and injections into the financial sector? Just like it happened in the past, massive spending and handouts to the financial industry only cover the current issues and delay the inevitable for a few more years. As many of you know, there will be discussions of raising the debt ceiling shortly. Take a look at this number and see if it does anything for you:

Shortly after the 1937-38 recession the U.S. borrowed money to rebuild its armed forces and manufacturing shoots up to gear up for war. Yet those conditions do not exist today since we are fighting wars with dispersed individuals that use low priced weapons. Where will government spending go? So far it has gone into the already bloated financial sector. If we look at China and their massive spending, you end up with empty cities, shopping malls built for millions with no customers, and over 60 million empty apartments. Simply spending money to build up GDP has a cost in the long-term. What an economy should aim for is sustainable growth through the actual demand by households, not artificial stimulus from the Federal Reserve. We are still stuck on real estate since banks have trillions of dollars of inflated properties on their balance sheets. What we face today is more in line with what Japan faced over their lost two decades. Giant spending and bailing out of the financial sector while allowing banks to keep bad loans in zombie portfolios.

The massive bailouts and stimulus programs are now waning and we are starting to see production pull back which shows us that much of the recent success largely comes from government spending. Yet how much will the real market sustain once this crutch is pulled back? The multiplier already shows us what we already know. The financial industry is largely siphoning money off the productive sectors of the economy in an ever growing fashion. With large contentious battles ahead and both parties aiming to cut large, we can expect a double-dip recession but let us hope that the real economy is strong enough to blunt the force of the massive financial bailouts ending (at least in theory). Ultimately what no politician will tell you is that we have financial pain ahead because we have spent too much and there is no free lunch at the end of the day except for the financial industry with deep pockets and lobbyist that ensure a win-win no matter what happens in the real world. The question revolves around who will suffer the deepest financial pain? Will it be those largely responsible for the financial gambling of our economy or the rest of Americans? So far the brunt has been suffered by working and middle class Americans.

Aside from the more important aspects of economic stability, the current path forward is not positive for real estate.