Another important data point that strongly suggests gold is far from a speculative bubble (where speculators and investors pile in - to make a ‘guaranteed’ profit) not based on fundamentals is the CFTC data released on Monday.

It showed that speculators, hedge funds and money managers pared their holdings of Comex gold futures and options in the week ended Nov. 22. The CFTC data, typically released Friday, was delayed because of the Thanksgiving holiday.

In gold futures and options, managed funds cut 21,697 long positions(or bets prices will rise) and added 679 short positions, beting prices will fall.

This reduced their net position by 13% to 149,256 long contracts, from 171,632 long contracts a week earlier.

The managed fund net long position represents around 14.9 million troy ounces of gold.

Any short term, speculative froth that was in the gold futures market as gold rose above $1,800 and then $1,900 has well and truly been diminished.

Total holdings of Comex gold futures and options are back at levels seen in 2009.

From Goldcore:

Gold is trading at USD 1,715.60, EUR 1,280.80, GBP 1,097.00, CHF 1,574.10 and JPY 133,280 per ounce.

Gold’s London AM fix this morning was USD 1,717.00, GBP 1,098.32, and EUR 1,278.67 per ounce.

Yesterday's AM fix was USD 1,714.00, GBP 1,100.41, and EUR 1,280.06 per ounce.

Gold Prices/ Fixes / Rates

Gold is marginally higher in dollars but lower in most currencies today. Gold is being supported by the dollar coming under pressure again and oil prices (WTI) rising 0.7%.

Asian stocks markets were mixed and European indices are tentatively higher.

Gold posted its second-largest one-day gain of the month yesterday on safe haven buying due to lingering concerns about the global debt crisis.

Gold has steadied despite the renewed increase in risk aversion as seen in higher stocks and the euro trading higher against the dollar after Italy sold 3 and 10 year debt ahead of a key meeting of euro zone finance ministers.

Cross Currency Rates

High hopes that the meeting could result in a comprehensive plan for leveraging the European Financial Stability Facility rescue fund look set to be dashed again.

Too much debt and leverage led to the financial crisis and has led to fiat currencies falling 11 years in a row against gold.

Further increases in debt and leverage will lead to a prolongation of gold’s bull market.

While gold has again displayed a short term correlation with risk assets such as equities, gold is set to outperform most equity indices again in November.

Reuters’ Amanda Cooper reports on the Reuters Global Gold Forum that so far in November, gold in Aussie dollars is set for the strongest performance, with a month-to-date gain of 5.4%, followed by gold in rand, up 4.8% and gold in Euros, which is up 3.5% in November.

Gold in yen is down 0.7% and gold in US dollars has fallen 0.3 %.

The MSCI World index is down 7% and the S&P is down 4.8% in November which again shows gold’s safe haven role in market turmoil.

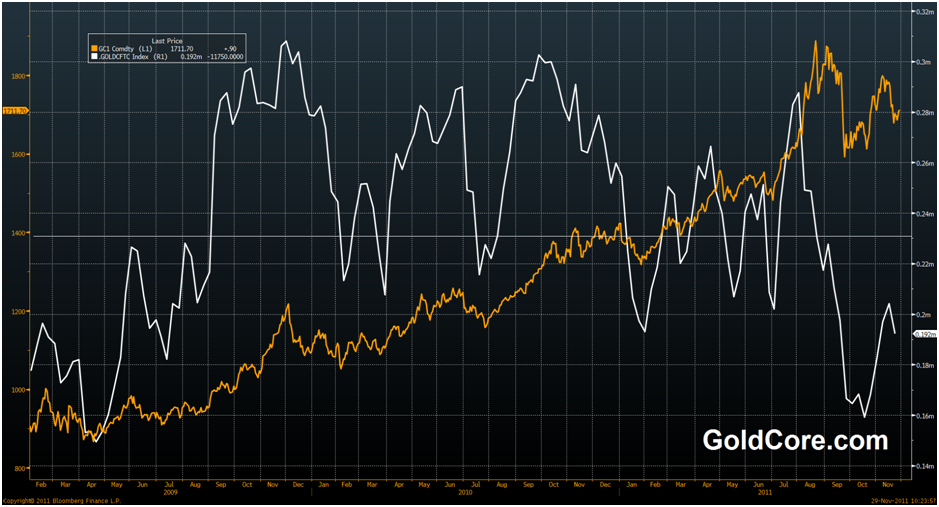

Net Long Gold Positions – (CFTC)

Concerns about whether gold is a bubble that is petering out continue despite a wealth of facts, data and clear evidence suggesting otherwise.

Another important data point that strongly suggests gold is far from a speculative bubble (where speculators and investors pile in - to make a ‘guaranteed’ profit) not based on fundamentals is the CFTC data released on Monday.

It showed that speculators, hedge funds and money managers pared their holdings of Comex gold futures and options in the week ended Nov. 22. The CFTC data, typically released Friday, was delayed because of the Thanksgiving holiday.

In gold futures and options, managed funds cut 21,697 long positions(or bets prices will rise) and added 679 short positions, beting prices will fall.

This reduced their net position by 13% to 149,256 long contracts, from 171,632 long contracts a week earlier.

The managed fund net long position represents around 14.9 million troy ounces of gold.

Any short term, speculative froth that was in the gold futures market as gold rose above $1,800 and then $1,900 has well and truly been diminished.

Total holdings of Comex gold futures and options are back at levels seen in 2009.

This shows that gold remains far from the speculative bubble alleged by Nouriel Roubini and some other vocal non gold experts.

Indeed, gold ownership remains extremely low amongst retail investors and the preserve of smart institutional money – including pension funds, hedge funds, banks, family offices and central banks.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $31.92/oz, €23.90/oz and £20.41/oz

PLATINUM GROUP METALS

Platinum is trading at $1,537.00/oz, palladium at $581.50/oz and rhodium at $1,575/oz.

NEWS

(Reuters)

Gold steady ahead of EU ministers meeting

(Financial Times)

Gold reserves begin their return to Venezuela

(Bloomberg)

Gold Will Reach $2000 an Ounce in `Near Future'

(CityWire)

Gold May Hit $3,000 if US Devalues Dollar

COMMENTARY

(RT)

Keiser Report: Roubini and GoldCore on Debt Crisis & Gold

(Financial Times)

James Mackintosh: Selling Bonds Backed By Gold Might Backfire

(KingWorldNews)

Marc Faber - No Free Markets, Just Government Manipulation

(Mineweb)

Alf Field: Gold price going to $4,500

(SeekingAlpha)

Gold: Time Tested Insurance Against A Stock Market Crisis

(CME Group)

CME: Are physical precious metals still in demand?

(ZeroHedge)

Steve Keen On Parasitic Bankers, Deluded Economists, and Why “We Are Already In The Second Great Depression”