The primary reason would appear to be that gold was overbought in the short term and speculative players decided to take profits. Official intervention, as has recently been seen in currency markets, may also have been a factor.

Many suggested that yesterday’s sell off was due to margin calls and wholesale liquidation of equity and other positions across the board.

However, if that was the case gold should have bounced as U.S. equities recovered yesterday. Liquidation driven selling should have seen commodities fall as well as equities but oil was $1 higher to $88.19 and the CRB only fell 0.14 to 334.10.

From Goldcore:

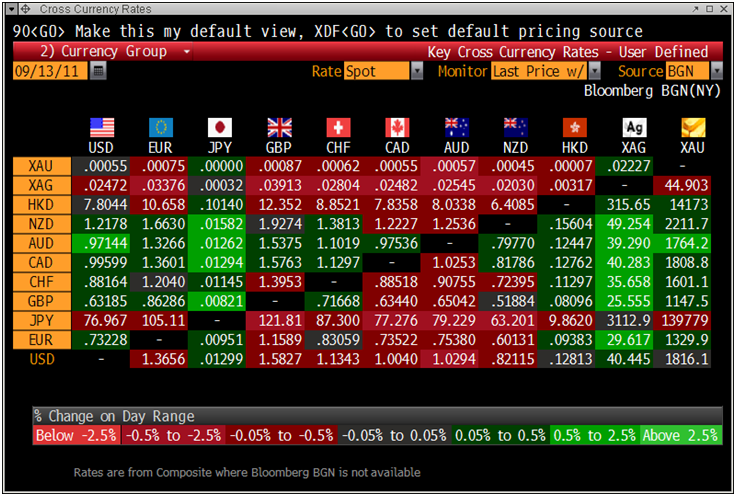

Gold is marginally lower in U.S. dollars and is trading at USD 1,816.60, EUR 1,329.90, GBP 1,147.90, JPY 139,820, AUD 1,763 and CHF 1,600 per ounce. Gold’s London AM fix this morning was USD 1,806.00, EUR 1,326.38, and GBP 1,143.33 per ounce. Yesterday’s AM fix was USD 1,843.00, EUR 1,354.94, and GBP 1,164.10 per ounce.

Cross Currency Table

Heightened worries about the sovereign debt crisis in Europe and contagion remain supportive of safe haven demand for bullion and therefore this sell off has all the hallmarks of another correction and healthy consolidation.

The primary reason would appear to be that gold was overbought in the short term and speculative players decided to take profits. Official intervention, as has recently been seen in currency markets, may also have been a factor.

Many suggested that yesterday’s sell off was due to margin calls and wholesale liquidation of equity and other positions across the board.

However, if that was the case gold should have bounced as U.S. equities recovered yesterday. Liquidation driven selling should have seen commodities fall as well as equities but oil was $1 higher to $88.19 and the CRB only fell 0.14 to 334.10.

Gold in US Dollars – 30 Day (Tick)

This sell off is likely to be shallow and of short duration again due to strong investment demand and physical demand from central banks and store of wealth buyers in Asia.

Support is at $1,790/oz and below that at $1,773/oz and strong support at $1,700/oz.

Recent record highs were driven by broad based global demand with speculative interest remaining negligible.

However, the recent sell off has seen speculators in gold futures raise their holdings last week for the first time since late July.

Last week, buyers of exchange-traded funds raised their holdings for the first time last week since mid August.

The sovereign debt crisis in the Eurozone and the risks posed to the U.S. economy is leading to safe haven demand from Europe and Asia. Very strong demand for gold has been seen from Germany in recent days.

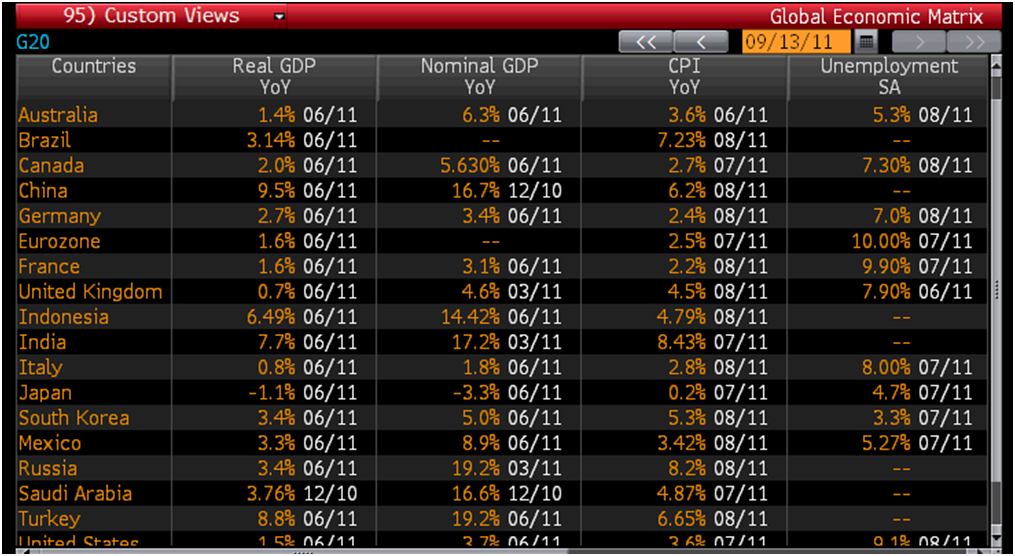

Meanwhile in Asia, very high inflation is leading to demand for bullion.

Global Economic Matrix

With the decline in gold prices from last week's record high, buyers have emerged in major Asian economies such as Indonesia, Thailand and Vietnam according to Reuters.

Demand in Vietnam remains very high with premiums of $31.42 over the spot price of $1,849.20/oz seen yesterday.

Physical trading in India has been subdued in recent days after strong demand seen recently. Indian ex duty premiums were low for the AM and PM London fixes yesterday. Indian traders will buy again on this dip in order to acquire stock for the upcoming festivals and weddings.

India is the biggest consumer of bullion followed by China who is catching up fast in terms of per capita consumption.

Wedding and festival demand in India is expected to gain pace in traditionally strong months of October and November.

India and China remain the key fundamental drivers of the gold market. Inflation hedging demand in India and China is set to continue for the foreseeable future with official inflation in India at 9% and official inflation in China at 6.5% (most recent inflation figures).

India’s inflation has remained stubbornly above 9% this year despite the central bank raising interest rates 11 times since March 2010. Similarly, China’s government has been tightening monetary policy in a bid to cool inflation.

India’s gold demand jumped 38% in the second quarter of 2011 from the same period a year earlier and China’s by 25%.

Demand for gold bars and coins leapt 78% in India and by 44% in the period.

Gold’s bull market will continue as long as the sovereign debt crisis in the Eurozone, economic problems in the U.S. are unresolved and inflation in Asia continues to drive demand from buyers and central banks.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $40.59/oz, €29.73/oz and £25.66/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,810.70/oz, palladium at $711/oz and rhodium at $1,750/oz.

NEWS

(Reuters)

Gold eases as firmer dollar piles on pressure

(Bloomberg)

Gold May Climb to $2,500 in the Next Year, Citigroup Says

(Reuters)

Gold rebounds 1 percent on persistent euro zone worries

(Washington Post)

Stephenson Says Gold to Rise `Well Beyond' $2,000 Ounce

(Business Week)

Morgan Stanley Positive on Gold as ‘Perfect Storm’ Continues

COMMENTARY

(The Globe and Mail)

What a Greek Default Would Look Like

(True Economics)

Gurdgiev: Global Contagion from Greece

(King World News)

Eveillard - Expect a Mania in Gold Before This is Over

(Financial Times)

Screenshot of Monday’s London interbank gold forward rates

(Zero Hedge)

Market Snapshot - The Other Silver-and-Black Not Winning

(Mineweb)

Gold Standard Talk - Economies Do Better with Sound Money