In Jim Willie's latest, he goes $10 past us, and predicts silver to hit $80 in the next 6 months.

Each of the last 3 times that silver's COT report was this bullish, silver rose from 60-90% over the next 6 months!

A similar rise from current prices will see The Doc's price target met, and likely surpassed in 2011.

Add QE3 into the analysis and silver has one heck of a bullish set-up.

We have stated repeatedly that the low-mid $30 level will be looked back upon in 12-18 months the same way that silver's 2005 and 2008 corrections are looked back on currently: If ONLY I had bought silver then!

From Jim Willie:

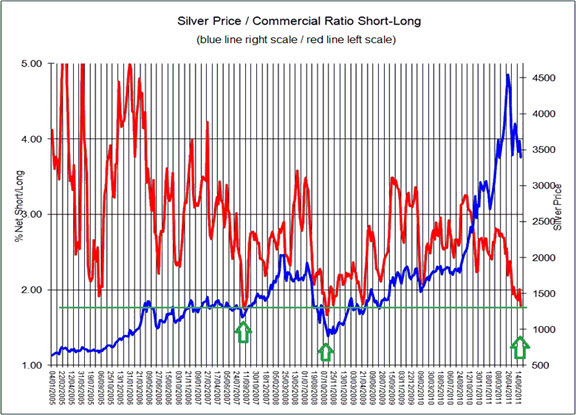

"The latest Commitment of Traders Report for silver is now screaming out at full volume BUY BUY BUY. In fact, the Commercial Short-Long Ratio that I have already bored you with at great length in recent correspondence is now down at a multi-year super extreme of 1.79. Below is an up-to-date chart of the COT picture. In summary there have only been four other weeks in this whole bull cycle where the ratio has dropped below 1.80, four weeks. The first two weeks of these was the 28th August 2007 and the following week of the 4th September 2007. The second tranche was the 21st October 2008 and the following week 28th October 2008. If you study below both the chart of silver over that period and also the HUI gold mining index, you can see how these extreme lows below 1.80 in the ratio coincided on both occasions very markedly with a bottom in both the silver price and the mining index. On each occasion this proved to be a multi-year opportunity to take positions in both the metal and the precious metal mining stocks. Each time the price of silver rose by some 60% to 90% within a six month period! And the HUI index rose some 90% to 160%. Folks, there is no such thing as a risk-free trade. There is no such thing as a free lunch. And there is no such thing as a one-way bet. However, there are certain times in an investment cycle when an outstanding opportunity presents itself and advantage should be taken. The evidence above shows very clearly the historic correlation between an extreme low below 1.80 on the Commercial Short-Long Ratio and a multi-month bottoming in the price of both silver and the precious metal mining stocks. I have been trading the precious metal sector since 2003 and I would consider this to be one of perhaps four of the most suitable buying opportunities within the last eight years!" The man RG makes a compelling argument, without providing the background factors that push the gold & silver prices upward. He simply points out the COT signal and the resulting performance after two significant lows were registered in precious metals prices. Very convincing inded. Thanks to RG also for the fine chart.

Note the green arrow in September 2007, a strong signal when silver was at a $12/oz price. Note the green arrow in October 2008, a strong signal when silver was just above the $9/oz price. The same type of signal is identified with yet another strong signal here & now in July 2011 with silver price at $35-36/oz. It is ready for the next big upleg. This time gold might lead, but as usual silver will follow and run fast and hard making yet more breathtaking gains. The great springtime consolidation is over.

Click here for more from Jim Willie's The Silver Platter Opportunity: